North America : Market Leader in Surveillance

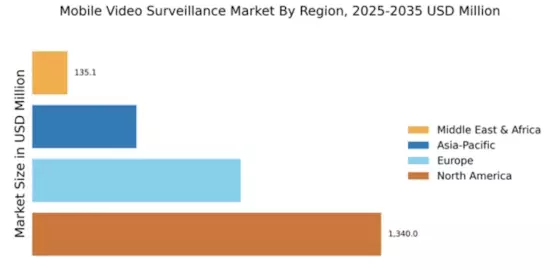

North America is poised to maintain its leadership in the mobile video surveillance market, holding a significant market share of 1340.0M in 2025. The growth is driven by increasing security concerns, technological advancements, and regulatory support for surveillance systems. The demand for mobile solutions is further fueled by the rise in smart city initiatives and public safety requirements, making it a critical region for market expansion. The competitive landscape in North America is robust, featuring key players such as Hikvision, FLIR Systems, and Honeywell. The U.S. stands out as the leading country, with substantial investments in security infrastructure. The presence of advanced technologies and a strong focus on innovation among local manufacturers contribute to the region's dominance, ensuring a thriving market for mobile video surveillance solutions.

Europe : Growing Demand for Security Solutions

Europe is experiencing a notable increase in the mobile video surveillance market, projected to reach 800.0M by 2025. The growth is driven by heightened security needs, regulatory frameworks promoting surveillance, and advancements in technology. Countries are increasingly adopting mobile surveillance solutions to enhance public safety and manage urban environments effectively, reflecting a growing trend towards integrated security systems. Leading countries in this region include Germany, the UK, and France, where key players like Bosch Security Systems and Axis Communications are making significant strides. The competitive landscape is characterized by innovation and collaboration among manufacturers, ensuring that Europe remains a vital market for mobile video surveillance. The European Union's commitment to enhancing security measures further supports this growth trajectory.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is emerging as a significant player in the mobile video surveillance market, with a projected size of 400.0M by 2025. The region's growth is fueled by urbanization, increasing crime rates, and government initiatives aimed at enhancing public safety. The demand for mobile surveillance solutions is on the rise as countries invest in smart city projects and advanced security technologies, creating a favorable environment for market expansion. Key countries such as China, Japan, and South Korea are leading the charge, with major players like Dahua Technology and Hanwha Techwin driving innovation. The competitive landscape is marked by rapid technological advancements and a focus on cost-effective solutions, positioning Asia-Pacific as a promising market for mobile video surveillance. However, challenges such as regulatory hurdles and market fragmentation remain.

Middle East and Africa : Emerging Security Landscape

The Middle East and Africa region is witnessing a gradual increase in the mobile video surveillance market, projected to reach 135.05M by 2025. The growth is driven by rising security concerns, urbanization, and government initiatives aimed at enhancing public safety. The demand for mobile surveillance solutions is expected to grow as countries invest in infrastructure and security technologies, reflecting a shift towards more integrated security systems. Leading countries in this region include the UAE and South Africa, where key players like Motorola Solutions and Pelco are establishing a presence. The competitive landscape is evolving, with a focus on innovative solutions tailored to local needs. As governments prioritize security measures, the market for mobile video surveillance is set to expand, presenting opportunities for growth and investment.