Rising Investment in Digital Transformation

In Mexico, the enterprise video market is significantly influenced by the rising investment in digital transformation initiatives. Organizations are increasingly recognizing the value of integrating video solutions into their digital strategies to improve customer engagement and internal communication. According to recent statistics, approximately 60% of Mexican companies have allocated substantial budgets towards digital transformation, with a considerable portion directed towards video technologies. This trend suggests that the enterprise video market is poised for growth as businesses seek innovative ways to leverage video content for training, marketing, and customer support. The emphasis on digital tools is likely to drive the adoption of sophisticated video platforms that cater to diverse organizational needs.

Growing Demand for Remote Collaboration Tools

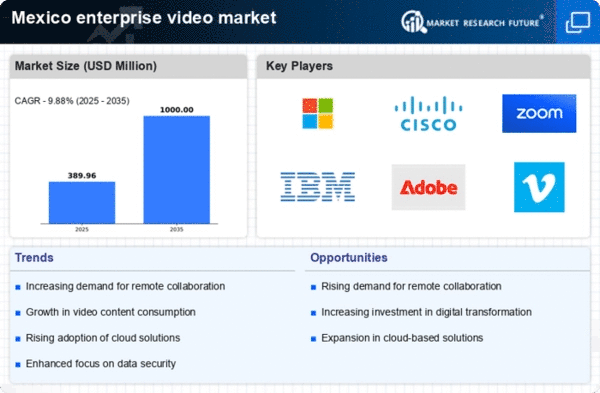

The enterprise video market in Mexico experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing platforms, which facilitate real-time interaction, are essential for maintaining productivity and engagement among remote teams. Recent data indicates that the market for video conferencing solutions in Mexico is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the necessity for seamless collaboration across various sectors, including education, healthcare, and corporate environments. Consequently, the enterprise video market is likely to witness a significant expansion as businesses invest in advanced video technologies to enhance their operational efficiency.

Increased Use of Video for Customer Engagement

In Mexico, the enterprise video market is experiencing an increase in the use of video for customer engagement. Businesses are leveraging video content to enhance their marketing strategies and connect with consumers on a deeper level. Recent data suggests that video marketing can lead to a 50% increase in engagement rates, making it a powerful tool for brands. As companies recognize the effectiveness of video in conveying messages and building relationships, the enterprise video market is likely to see substantial growth. This trend is particularly evident in sectors such as retail and e-commerce, where video content plays a crucial role in driving sales and improving customer experiences.

Advancements in Video Technology and Infrastructure

The enterprise video market in Mexico is significantly impacted by advancements in video technology and infrastructure. The proliferation of high-speed internet and improved network capabilities enable organizations to adopt more sophisticated video solutions. Recent reports indicate that approximately 80% of urban areas in Mexico now have access to high-speed internet, facilitating the seamless delivery of video content. This technological evolution suggests that the enterprise video market is poised for growth as businesses invest in cutting-edge video platforms that offer enhanced features such as 4K streaming and interactive capabilities. As organizations seek to improve their video communication strategies, the demand for advanced video technologies is likely to increase.

Enhanced Focus on Employee Training and Development

The enterprise video market in Mexico is witnessing an enhanced focus on employee training and development. Companies are increasingly utilizing video-based training programs to improve workforce skills and knowledge retention. This shift is driven by the recognition that video content can deliver information more effectively than traditional methods. Recent surveys indicate that approximately 70% of organizations in Mexico are investing in video training solutions, reflecting a growing trend towards e-learning. As a result, the enterprise video market is likely to expand as businesses prioritize employee development through engaging and interactive video content. This approach not only enhances learning outcomes but also fosters a culture of continuous improvement within organizations.