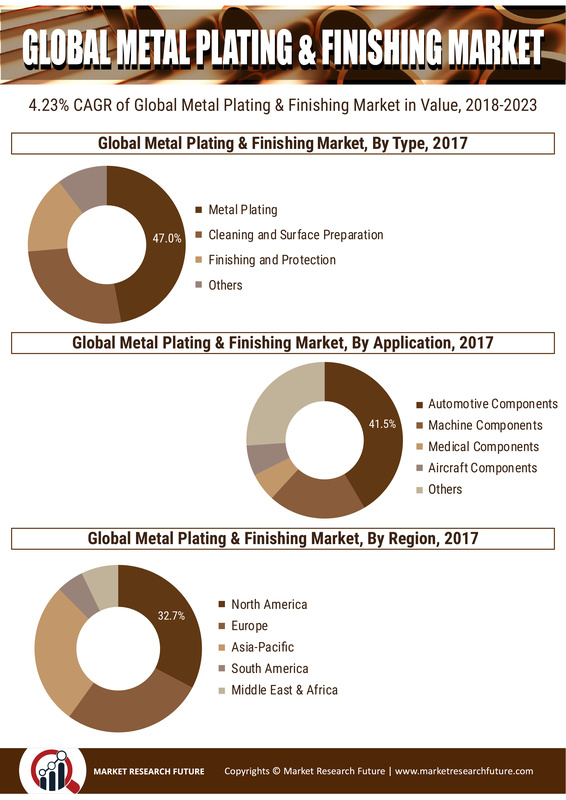

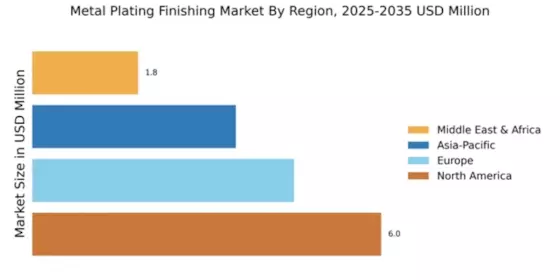

Market Growth Projections

The Global Metal Plating and Finishing Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 3.94% from 2025 to 2035. This growth trajectory reflects the increasing demand across various sectors, including automotive, electronics, and consumer goods. The market is expected to reach 11.2 USD Billion by 2035, driven by advancements in technology and rising consumer expectations for quality finishes. Such projections highlight the industry's resilience and adaptability in meeting the evolving needs of diverse markets.

Increasing Focus on Aesthetic Appeal

Aesthetic considerations are increasingly driving the Global Metal Plating and Finishing Market Industry, particularly in consumer goods and luxury items. Manufacturers are recognizing the value of visually appealing finishes that enhance product attractiveness and marketability. This trend is evident in sectors such as jewelry, home appliances, and decorative hardware, where plating techniques are employed to achieve desired aesthetics. As consumer preferences evolve, the demand for high-quality finishes is likely to grow, indicating a potential for market expansion as companies strive to differentiate their products through superior plating solutions.

Rising Demand for Automotive Components

The Global Metal Plating and Finishing Market Industry experiences a notable surge in demand driven by the automotive sector. As manufacturers increasingly seek to enhance the durability and aesthetic appeal of vehicle components, metal plating processes such as electroplating and anodizing become essential. In 2024, the market is projected to reach 7.34 USD Billion, reflecting the industry's adaptation to evolving consumer preferences for high-quality finishes. Furthermore, the anticipated growth in electric vehicle production may further stimulate demand for advanced metal finishing techniques, indicating a robust trajectory for the industry.

Growth in Electronics and Electrical Equipment

The Global Metal Plating and Finishing Market Industry is significantly influenced by the burgeoning electronics and electrical equipment sector. As electronic devices become more ubiquitous, the need for high-performance metal finishes that ensure conductivity and corrosion resistance intensifies. This sector's growth is expected to contribute substantially to the market, with projections indicating a rise to 11.2 USD Billion by 2035. The demand for plated components in smartphones, computers, and other electronic devices underscores the importance of metal finishing processes, suggesting a sustained upward trend in the industry.

Technological Advancements in Plating Techniques

Technological innovations play a pivotal role in shaping the Global Metal Plating and Finishing Market Industry. The introduction of advanced techniques, such as vacuum plating and environmentally friendly processes, enhances efficiency and reduces waste. These innovations not only improve the quality of finishes but also align with global sustainability initiatives. As industries increasingly prioritize eco-friendly practices, the adoption of these technologies is likely to accelerate. This trend suggests a potential for market expansion, as companies invest in modernizing their plating facilities to meet regulatory standards and consumer expectations.

Regulatory Compliance and Environmental Standards

The Global Metal Plating and Finishing Market Industry faces increasing pressure to comply with stringent environmental regulations. Governments worldwide are implementing policies aimed at reducing hazardous waste and promoting sustainable practices within the plating sector. This regulatory landscape compels companies to adopt cleaner technologies and processes, which may initially pose challenges but ultimately drive innovation. As firms invest in compliance measures, the industry may witness a shift towards more sustainable plating solutions, potentially enhancing market growth as environmentally conscious consumers favor products that align with their values.