Rising Demand for Consumer Electronics

The consumer electronics sector is emerging as a vital driver for the US Metal Plating And Finishing Market. As technology continues to advance, the demand for aesthetically pleasing and durable electronic components is on the rise. Products such as smartphones, laptops, and home appliances require high-quality metal finishes to enhance their visual appeal and functionality. By 2025, the consumer electronics industry is anticipated to contribute significantly to the market, with a projected growth rate of approximately 6% annually. This trend compels manufacturers to innovate and adopt advanced plating techniques that not only meet aesthetic standards but also ensure the longevity and performance of electronic devices.

Growing Demand from the Automotive Sector

The automotive sector is a significant driver of growth in the US Metal Plating And Finishing Market. With the increasing production of vehicles, there is a heightened demand for high-quality metal components that require effective plating and finishing. As of 2025, the automotive industry is projected to account for nearly 30% of the total market share, reflecting a robust growth trajectory. This demand is fueled by the need for corrosion resistance, aesthetic appeal, and enhanced durability of automotive parts. Manufacturers are responding by investing in advanced plating technologies to meet these requirements, thereby positioning themselves to capitalize on the expanding automotive market.

Technological Innovations in Metal Finishing

Technological advancements play a pivotal role in shaping the US Metal Plating And Finishing Market. Innovations such as electroplating, electroless plating, and advanced coating techniques are enhancing the efficiency and quality of metal finishing processes. The integration of automation and robotics in plating operations is streamlining production, reducing labor costs, and minimizing human error. As of 2025, the market is expected to witness a surge in demand for these technologies, with a projected growth rate of around 5% annually. Companies that invest in cutting-edge technologies are likely to improve their operational efficiency and product quality, thereby meeting the evolving demands of various sectors, including automotive and aerospace.

Regulatory Compliance and Environmental Standards

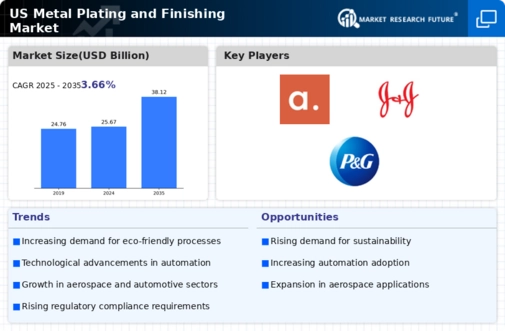

The US Metal Plating And Finishing Market is increasingly influenced by stringent regulatory compliance and environmental standards. The Environmental Protection Agency (EPA) has established guidelines that necessitate the reduction of hazardous waste and emissions from plating processes. Companies are compelled to adopt eco-friendly practices, which may involve investing in advanced filtration and waste treatment technologies. This shift not only aligns with regulatory requirements but also enhances the industry's sustainability profile. As of 2025, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5%, driven by these compliance measures. Firms that proactively adapt to these regulations are likely to gain a competitive edge, positioning themselves favorably in a market that increasingly values environmental responsibility.

Increased Investment in Infrastructure Development

Infrastructure development is a crucial driver for the US Metal Plating And Finishing Market. The ongoing investments in public and private infrastructure projects, including bridges, highways, and buildings, necessitate the use of metal components that require effective plating and finishing. As of 2025, infrastructure spending in the US is expected to reach over $1 trillion, creating substantial opportunities for metal plating companies. This surge in demand is likely to stimulate growth in the market, as construction projects require durable and corrosion-resistant materials. Companies that align their offerings with the needs of the infrastructure sector are poised to benefit from this trend, potentially leading to increased market share and profitability.