Energy Sector Expansion

The expansion of the energy sector, particularly in oil and gas, is significantly influencing the Global Metal Pipes Market Industry. Metal pipes are essential for transporting oil, gas, and other fluids safely and efficiently. With the global energy demand rising, investments in exploration and production activities are increasing, which in turn drives the need for high-quality metal piping solutions. The industry is poised for growth, with forecasts suggesting a market value of 289.9 USD Billion by 2035. This expansion indicates a robust compound annual growth rate of 5.9% from 2025 to 2035, highlighting the critical role of metal pipes in supporting energy infrastructure.

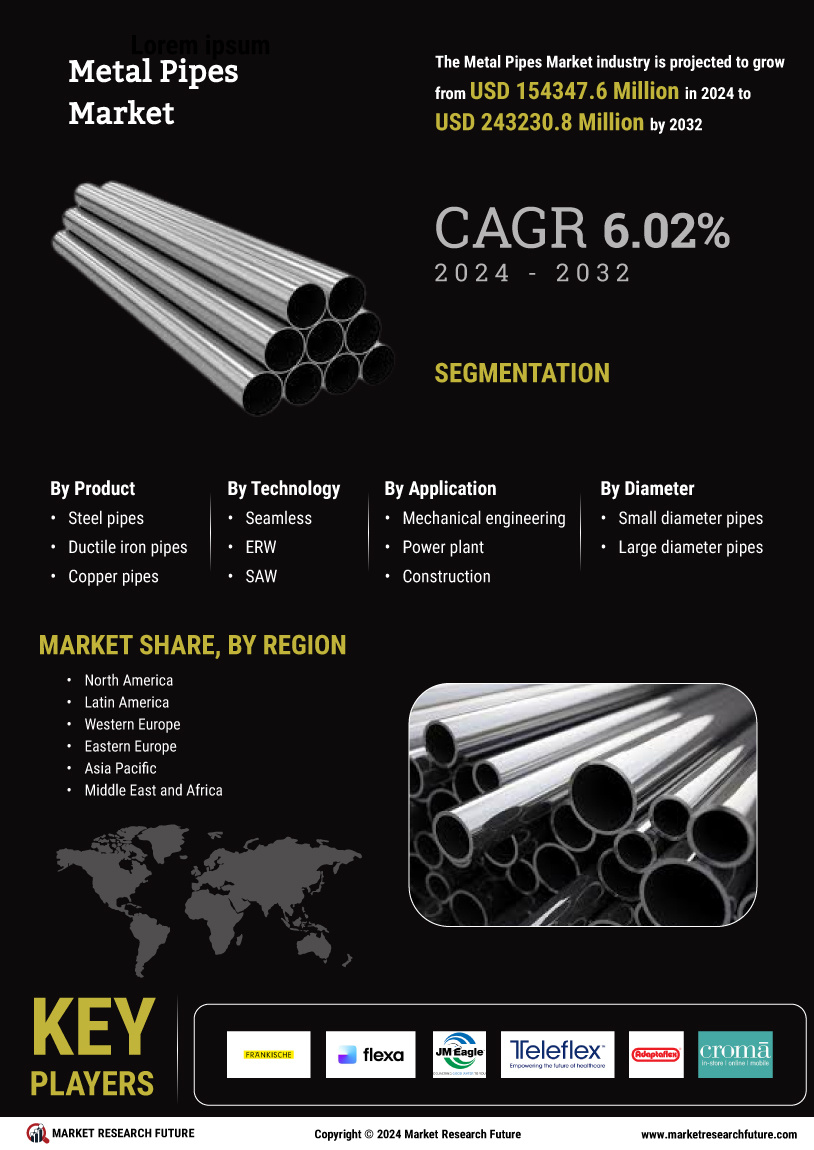

Market Growth Projections

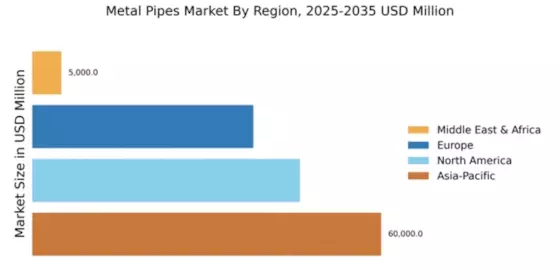

The Global Metal Pipes Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 154.3 USD Billion in 2024 and an anticipated increase to 289.9 USD Billion by 2035, the industry is poised for a compound annual growth rate of 5.9% from 2025 to 2035. This growth trajectory reflects the increasing demand for metal pipes across various sectors, including construction, energy, and water management. The market's expansion is indicative of the essential role that metal pipes play in supporting infrastructure and industrial applications globally.

Infrastructure Development

The ongoing global infrastructure development initiatives are a primary driver for the Global Metal Pipes Market Industry. Governments worldwide are investing heavily in transportation, water supply, and energy projects, which necessitate the use of metal pipes. For instance, the construction of new highways and bridges often requires robust piping systems to manage water drainage and utilities. This trend is expected to contribute to the market's growth, with projections indicating a market value of 154.3 USD Billion in 2024. As infrastructure projects expand, the demand for durable and reliable metal pipes is likely to increase, further propelling the industry forward.

Technological Advancements

Technological advancements in manufacturing processes are reshaping the Global Metal Pipes Market Industry. Innovations such as automated welding and advanced coating techniques enhance the quality and performance of metal pipes. These improvements not only increase production efficiency but also reduce costs, making metal pipes more accessible to various industries. As manufacturers adopt these technologies, the market is likely to see a surge in demand for high-performance piping solutions. This evolution in production capabilities aligns with the industry's growth projections, suggesting a robust future for metal pipes across multiple sectors.

Water Management Initiatives

Water management initiatives are becoming increasingly vital in addressing global water scarcity issues, thereby driving the Global Metal Pipes Market Industry. Governments and organizations are implementing projects to enhance water supply systems, wastewater treatment, and irrigation. Metal pipes are favored for their durability and resistance to corrosion, making them ideal for various water management applications. As urbanization continues to rise, the demand for efficient water distribution systems is expected to grow. This trend underscores the necessity for metal pipes, contributing to the industry's anticipated growth trajectory and reinforcing their importance in sustainable development.

Regulatory Compliance and Standards

Regulatory compliance and standards play a crucial role in shaping the Global Metal Pipes Market Industry. Governments are enforcing stringent regulations regarding safety, environmental impact, and quality standards for piping materials. Compliance with these regulations often necessitates the use of high-quality metal pipes that meet specific criteria. This regulatory landscape drives manufacturers to innovate and improve their products, ensuring they adhere to the latest standards. As industries strive to meet these requirements, the demand for compliant metal piping solutions is expected to rise, further fueling market growth.