Regulatory Compliance and Standards

The metal pipes market is significantly influenced by stringent regulatory frameworks and compliance standards in the US. Various federal and state regulations mandate the use of specific materials and manufacturing processes to ensure safety and environmental protection. For instance, the Environmental Protection Agency (EPA) has established guidelines that impact the types of materials used in plumbing and construction. Compliance with these regulations often necessitates the use of metal pipes, which are known for their longevity and resistance to corrosion. As industries strive to meet these standards, the demand for compliant metal pipes is expected to rise. This regulatory landscape not only drives sales but also encourages manufacturers to innovate and improve their product offerings, thereby enhancing the overall market landscape.

Rising Demand in Construction Sector

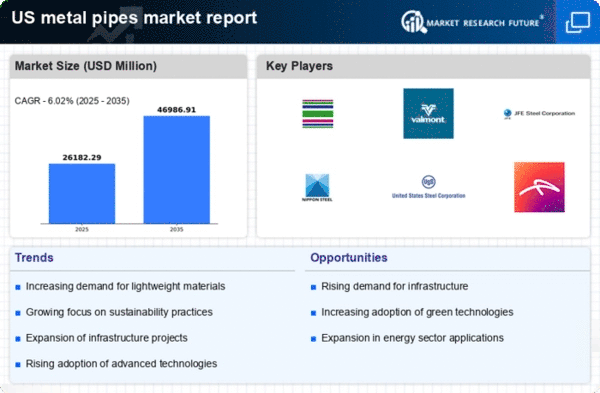

The construction sector in the US is experiencing a notable resurgence, which appears to be a primary driver for the metal pipes market. With the projected growth rate of the construction industry estimated at around 4.5% annually, the demand for metal pipes is likely to increase significantly. Metal pipes are essential for various applications, including plumbing, HVAC systems, and structural support. As urbanization continues to expand, the need for robust infrastructure is becoming increasingly critical. This trend suggests that the metal pipes market will benefit from heightened construction activities, leading to increased sales and production. Furthermore, the ongoing development of smart cities and sustainable buildings may further bolster the demand for high-quality metal pipes, as they are favored for their durability and recyclability.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are reshaping the metal pipes market. Innovations such as automated production lines and advanced welding techniques are enhancing efficiency and reducing costs. The integration of Industry 4.0 technologies, including IoT and AI, is enabling manufacturers to optimize production and improve quality control. As a result, the market is witnessing a shift towards more sophisticated and high-performance metal pipes. This trend is likely to attract new investments, as companies seek to leverage these technologies to gain a competitive edge. Moreover, the ability to produce customized metal pipes tailored to specific applications may further stimulate demand, particularly in specialized sectors such as oil and gas, where precision is paramount.

Increased Focus on Water Management Solutions

Water management is becoming an increasingly pressing issue in the US, which appears to be a significant driver for the metal pipes market. As water scarcity and quality concerns rise, municipalities and industries are investing in infrastructure to improve water distribution and treatment systems. Metal pipes are often preferred for their durability and resistance to corrosion, making them ideal for long-term water management solutions. The US government has allocated substantial funding for water infrastructure projects, with estimates suggesting over $50 billion in investments over the next five years. This financial commitment is likely to enhance the demand for metal pipes, as they play a crucial role in ensuring efficient water delivery and management.

Growing Energy Sector and Infrastructure Needs

The energy sector in the US is undergoing significant transformations, which is likely to impact the metal pipes market positively. With the increasing focus on renewable energy sources and the modernization of existing infrastructure, there is a heightened demand for metal pipes. These pipes are essential for transporting oil, gas, and water, making them critical components in energy projects. The US Department of Energy has indicated that investments in energy infrastructure could reach $100 billion over the next decade. This influx of capital is expected to drive the demand for metal pipes, as companies seek reliable and durable solutions for their energy transportation needs. Consequently, the metal pipes market stands to benefit from this growing sector.