Rising Male Grooming Culture

The rising male grooming culture contributes to the expansion of the Global Men's Hair Loss Prevention and Growth Products Industry. As societal norms evolve, men increasingly prioritize personal care, including hair health. This cultural shift is evidenced by the growing number of grooming products available, with the market expected to grow significantly. The increasing acceptance of grooming routines among men indicates a potential for sustained growth, as more individuals invest in products that promote hair health and prevent loss.

E-commerce Growth and Accessibility

The growth of e-commerce platforms enhances accessibility to hair loss prevention and growth products, significantly impacting the Global Men's Hair Loss Prevention and Growth Products Industry. Online shopping provides consumers with a wider range of products and the convenience of purchasing from home. This trend is particularly relevant as more men turn to online resources for hair care solutions. The ease of access to information and product reviews online further empowers consumers, likely contributing to the market's expansion in the coming years.

Aging Population and Hair Loss Concerns

The aging population presents a significant driver for the Global Men's Hair Loss Prevention and Growth Products Industry. As men age, they often experience hair thinning and loss, leading to increased demand for effective solutions. This demographic trend is crucial, as it indicates a growing market segment that seeks products to combat hair loss. The market's growth is further supported by the projected CAGR of 12.82% from 2025 to 2035, reflecting the increasing need for hair loss prevention and growth products among older men.

Technological Advancements in Hair Care

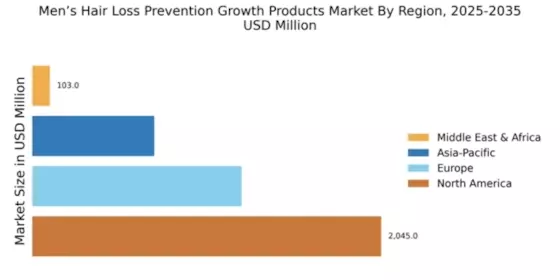

Technological advancements in hair care formulations and delivery systems are pivotal in shaping the Global Men's Hair Loss Prevention and Growth Products Industry. Innovations such as laser therapy devices and topical solutions with enhanced absorption capabilities are becoming more prevalent. These advancements not only improve product efficacy but also attract consumers seeking cutting-edge solutions. As a result, the market is likely to experience robust growth, with projections indicating a rise to 2580.8 USD Million by 2035, driven by the demand for innovative hair loss treatments.

Increasing Awareness of Hair Loss Solutions

The growing awareness regarding hair loss solutions significantly drives the Global Men's Hair Loss Prevention and Growth Products Industry. As men become more informed about the causes and treatments for hair loss, they are more likely to seek effective products. This trend is reflected in the increasing sales of hair growth products, which are projected to reach 684.8 USD Million in 2024. Educational campaigns and advertisements play a crucial role in this awareness, leading to a more informed consumer base that actively seeks out solutions for hair loss.