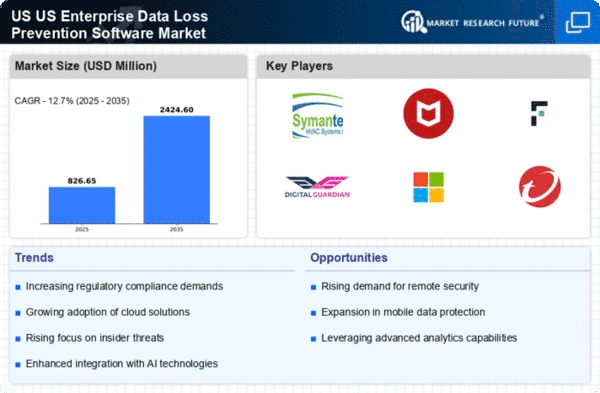

The Enterprise Data Loss Prevention Software Market is currently characterized by a dynamic competitive landscape, driven by the increasing need for organizations to safeguard sensitive data against breaches and unauthorized access. Key players such as Symantec (US), McAfee (US), and Microsoft (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Symantec (US) focuses on innovation through continuous product development, while McAfee (US) emphasizes strategic partnerships to expand its service offerings. Microsoft (US), leveraging its extensive cloud infrastructure, aims to integrate advanced data protection features into its existing platforms, thereby enhancing user experience and security. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological advancement and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing supply chains to enhance efficiency, and investing in advanced technologies to improve product offerings. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for a diverse range of solutions, catering to various customer needs while fostering healthy competition among established and emerging firms.

In December 2025, Forcepoint (US) announced a strategic acquisition of a leading AI-driven analytics firm, aiming to bolster its data protection capabilities. This acquisition is likely to enhance Forcepoint's ability to provide real-time threat detection and response, positioning the company as a formidable player in the market. The integration of AI technologies into their offerings may significantly improve the effectiveness of their data loss prevention solutions, thereby attracting a broader customer base.

In November 2025, Digital Guardian (US) launched a new version of its data loss prevention software, incorporating machine learning algorithms to enhance data classification and protection. This move indicates a strong commitment to innovation and reflects the growing trend of utilizing AI to improve data security measures. By enhancing its product capabilities, Digital Guardian (US) aims to differentiate itself in a competitive market, potentially increasing its market share.

In October 2025, Cisco (US) expanded its data loss prevention portfolio by introducing a cloud-native solution designed to protect data across various environments. This strategic initiative aligns with the increasing demand for cloud-based security solutions, suggesting that Cisco (US) is positioning itself to capitalize on the ongoing digital transformation within enterprises. The introduction of such solutions may enhance Cisco's competitive edge, particularly among organizations transitioning to cloud infrastructures.

As of January 2026, the competitive trends within the Enterprise Data Loss Prevention Software Market are increasingly defined by digitalization, AI integration, and a focus on sustainability. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. Moving forward, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, reliability, and the ability to provide comprehensive, integrated solutions that address the complex data protection needs of organizations.