Focus on Cybersecurity

As cyber threats continue to evolve, the Global Memory and Processors for Military and Aerospace Applications Market Industry is witnessing a heightened focus on cybersecurity measures. Military applications require secure and resilient memory and processing solutions to protect sensitive information from potential breaches. This demand for enhanced security features is driving innovation in memory and processor technologies, ensuring that they can withstand cyber threats. Consequently, defense organizations are increasingly investing in advanced technologies that not only meet operational requirements but also provide robust cybersecurity capabilities, further fueling market growth.

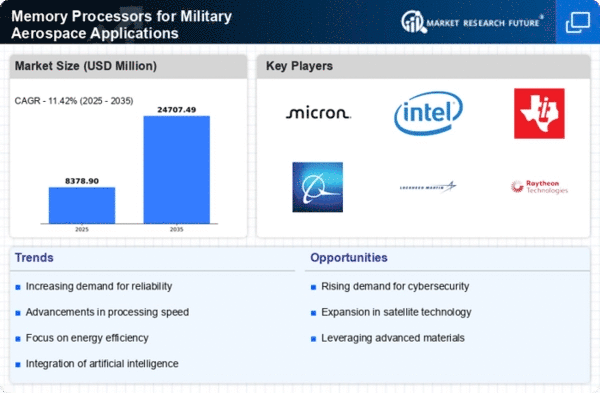

Market Growth Projections

The Global Memory and Processors for Military and Aerospace Applications Market Industry is poised for substantial growth, with projections indicating a market value of 23.0 USD Billion by 2035. The anticipated compound annual growth rate (CAGR) of 10.68% from 2025 to 2035 reflects the increasing demand for advanced memory and processing solutions in military applications. This growth trajectory is influenced by factors such as rising defense budgets, technological advancements, and the integration of AI. The market is expected to evolve significantly, driven by the need for enhanced performance and security in military systems.

Increasing Defense Budgets

The Global Memory and Processors for Military and Aerospace Applications Market Industry is experiencing growth driven by rising defense budgets across various nations. Countries are allocating substantial resources to enhance their military capabilities, which includes investing in advanced memory and processor technologies. For instance, the global defense expenditure is projected to reach approximately 7.52 USD Billion in 2024, reflecting a commitment to modernization and technological superiority. This trend indicates a robust demand for sophisticated memory and processing solutions that can support advanced military systems, thereby propelling the market forward.

Technological Advancements

Rapid technological advancements in memory and processor technologies are significantly influencing the Global Memory and Processors for Military and Aerospace Applications Market Industry. Innovations such as the development of high-speed, low-power memory solutions and advanced processing architectures are enabling military applications to operate more efficiently and effectively. These advancements not only enhance performance but also reduce the overall weight and power consumption of military systems. As a result, the market is expected to grow, with projections indicating a value of 23.0 USD Billion by 2035, driven by the continuous evolution of technology in defense applications.

Growing Demand for Data Processing

The increasing volume of data generated by military operations is driving the demand for advanced memory and processors in the Global Memory and Processors for Military and Aerospace Applications Market Industry. As military systems become more reliant on data analytics and real-time processing, the need for high-capacity memory and powerful processors becomes paramount. This trend is further supported by the anticipated compound annual growth rate (CAGR) of 10.68% from 2025 to 2035, indicating a robust market expansion. The ability to process large datasets efficiently is crucial for decision-making and operational effectiveness in modern military environments.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into military applications is reshaping the Global Memory and Processors for Military and Aerospace Applications Market Industry. AI technologies necessitate advanced memory and processing capabilities to support complex algorithms and real-time data analysis. As military systems increasingly adopt AI for decision-making, surveillance, and autonomous operations, the demand for high-performance memory and processors is expected to surge. This trend aligns with the projected market growth, as organizations seek to leverage AI to enhance operational efficiency and effectiveness in various military applications.