Technological Advancements in Robotics

Technological advancements play a crucial role in shaping the Medical Robotic Systems Market. Innovations such as artificial intelligence, machine learning, and enhanced imaging technologies are revolutionizing surgical procedures. These advancements not only improve the accuracy and efficiency of surgeries but also facilitate better training for surgeons. The integration of AI in robotic systems is expected to enhance decision-making processes during surgeries, potentially leading to improved patient outcomes. As these technologies continue to evolve, the Medical Robotic Systems Market is likely to witness increased investment and adoption, further solidifying its position in modern healthcare.

Aging Population and Increased Chronic Diseases

The Medical Robotic Systems Market is significantly influenced by the aging population and the rising prevalence of chronic diseases. As the global demographic shifts towards an older population, the demand for surgical interventions is expected to rise. Older adults often require surgeries for conditions such as orthopedic issues, cardiovascular diseases, and cancer, which can benefit from robotic assistance. Data suggests that by 2030, the number of individuals aged 65 and older will reach approximately 1.5 billion, further driving the need for advanced surgical solutions. Consequently, the Medical Robotic Systems Market is poised for growth as healthcare systems adapt to meet the needs of this demographic.

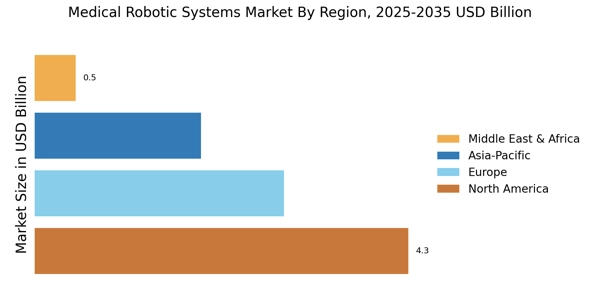

Growing Investment in Healthcare Infrastructure

The Medical Robotic Systems Market is benefiting from increased investment in healthcare infrastructure across various regions. Governments and private entities are recognizing the importance of advanced medical technologies in improving healthcare delivery. This investment is often directed towards upgrading surgical facilities and acquiring state-of-the-art robotic systems. For instance, recent reports indicate that healthcare spending is projected to rise by over 5% annually in many regions, with a significant portion allocated to robotic systems. This trend suggests that the Medical Robotic Systems Market will continue to thrive as healthcare providers seek to enhance their capabilities and improve patient care.

Rising Demand for Minimally Invasive Procedures

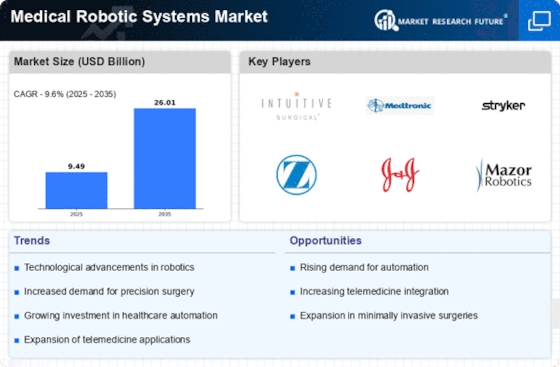

The Medical Robotic Systems Market is experiencing a notable surge in demand for minimally invasive surgical procedures. This trend is largely driven by the advantages these procedures offer, such as reduced recovery times, lower risk of infection, and minimized scarring. According to recent data, the market for minimally invasive surgeries is projected to grow at a compound annual growth rate of approximately 10% over the next few years. As healthcare providers increasingly adopt robotic systems to enhance surgical precision and patient outcomes, the Medical Robotic Systems Market is likely to expand significantly. This shift not only reflects a change in surgical practices but also indicates a broader acceptance of advanced technologies in healthcare settings.

Rising Awareness and Acceptance of Robotic Surgery

The Medical Robotic Systems Market is witnessing a rise in awareness and acceptance of robotic-assisted surgeries among both healthcare professionals and patients. Educational initiatives and successful case studies are contributing to a better understanding of the benefits associated with robotic systems. As patients become more informed about their surgical options, they are increasingly inclined to choose robotic-assisted procedures, which are often perceived as safer and more effective. This growing acceptance is likely to drive demand for robotic systems, thereby propelling the Medical Robotic Systems Market forward. The trend indicates a shift in patient preferences, which healthcare providers must consider in their service offerings.