Medical Payment Fraud Detection Market Summary

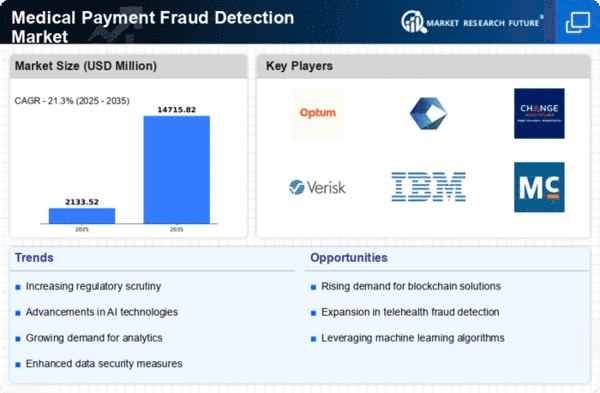

As per MRFR analysis, the Medical Payment Fraud Detection Market was estimated at 1758.88 USD Million in 2024. The Medical Payment Fraud Detection industry is projected to grow from 2133.56 USD Million in 2025 to 14715.82 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 21.3 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Medical Payment Fraud Detection Market is poised for substantial growth driven by technological advancements and increasing regulatory scrutiny.

- The integration of Artificial Intelligence is transforming fraud detection methodologies across the healthcare sector.

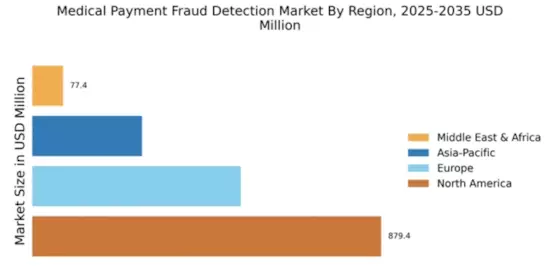

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for medical payment fraud detection solutions.

- Fraud Detection services dominate the market, whereas Data Analytics is witnessing the fastest growth due to evolving data needs.

- Rising incidence of healthcare fraud and increasing regulatory scrutiny are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 1758.88 (USD Million) |

| 2035 Market Size | 14715.82 (USD Million) |

| CAGR (2025 - 2035) | 21.3% |

Major Players

Optum (US), Cognizant (US), Change Healthcare (US), Verisk Analytics (US), IBM (US), McKesson (US), Quest Diagnostics (US), Hewlett Packard Enterprise (US)