Regulatory Standards and Compliance

Regulatory standards play a crucial role in shaping the Medical Equipment Cooling Market. Compliance with stringent regulations regarding equipment performance and safety necessitates the implementation of effective cooling solutions. Manufacturers are compelled to innovate and enhance their cooling technologies to meet these standards. The market is witnessing a rise in demand for cooling systems that not only comply with regulations but also improve energy efficiency. As regulatory bodies continue to enforce guidelines, the industry is likely to see advancements in cooling technologies that align with compliance requirements, thereby fostering market growth.

Integration of IoT in Medical Equipment

The integration of Internet of Things (IoT) technology in medical equipment is transforming the landscape of healthcare. IoT-enabled devices require consistent and efficient cooling to function optimally, thereby driving the Medical Equipment Cooling Market. These smart devices collect and transmit data, necessitating advanced cooling solutions to prevent overheating and ensure reliability. The market is witnessing a shift towards smart cooling systems that can monitor temperature in real-time and adjust accordingly. This trend not only enhances the performance of medical devices but also contributes to better patient outcomes, as equipment remains operational and efficient.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare, which is influencing the Medical Equipment Cooling Market. As healthcare providers prioritize early diagnosis and treatment, the demand for diagnostic equipment rises. This equipment often requires sophisticated cooling systems to maintain accuracy and reliability. The market is responding to this trend by developing innovative cooling solutions that cater to the specific needs of diagnostic devices. With the healthcare sector investing heavily in preventive measures, the cooling market is likely to expand, ensuring that medical equipment remains functional and effective in delivering timely healthcare services.

Rising Demand for Advanced Medical Equipment

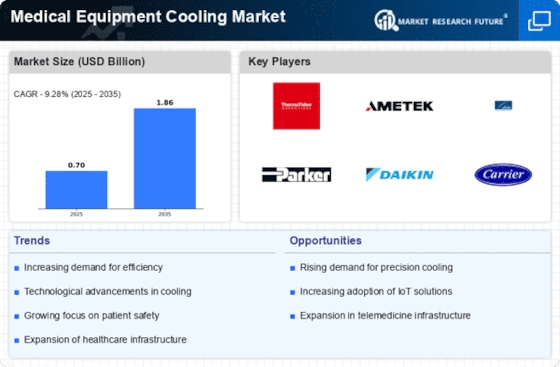

The increasing prevalence of chronic diseases and the aging population are driving the demand for advanced medical equipment. This surge necessitates efficient cooling solutions to maintain optimal performance and longevity of devices. The Medical Equipment Cooling Market is experiencing growth as healthcare facilities invest in high-tech equipment that requires specialized cooling systems. According to recent data, the market for medical devices is projected to reach substantial figures, indicating a robust need for effective cooling solutions. As hospitals and clinics expand their capabilities, the demand for reliable cooling systems becomes paramount, ensuring that equipment operates within safe temperature ranges and enhances patient care.

Emerging Markets and Healthcare Infrastructure Development

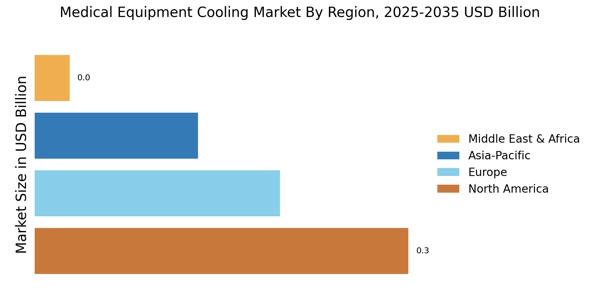

Emerging markets are witnessing rapid development in healthcare infrastructure, which is significantly impacting the Medical Equipment Cooling Market. As these regions invest in modern medical facilities, the demand for advanced medical equipment and corresponding cooling solutions is on the rise. The expansion of healthcare services in these markets creates opportunities for cooling system manufacturers to introduce innovative products tailored to local needs. This trend suggests a potential for substantial growth in the cooling market as healthcare providers seek reliable solutions to support their expanding operations and enhance patient care.