Technological Innovations

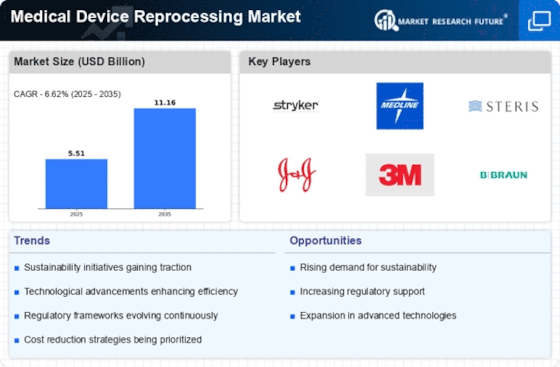

Technological advancements play a pivotal role in the Medical Device Reprocessing Market. Innovations in sterilization techniques and quality assurance processes have enhanced the safety and efficacy of reprocessed devices. For instance, the introduction of advanced cleaning technologies and monitoring systems has improved the reliability of reprocessing, addressing previous concerns regarding safety. As these technologies evolve, they are expected to facilitate the broader acceptance of reprocessed devices among healthcare providers. The market is witnessing a surge in investments aimed at developing more efficient reprocessing technologies, which could further bolster the Medical Device Reprocessing Market in the coming years.

Environmental Sustainability

The Medical Device Reprocessing Market is also influenced by the growing emphasis on environmental sustainability. The healthcare sector is one of the largest contributors to waste, with single-use medical devices generating substantial amounts of non-biodegradable waste. Reprocessing these devices not only reduces waste but also conserves resources, aligning with global sustainability goals. Many healthcare organizations are now adopting reprocessing as part of their environmental strategies, which is expected to drive market growth. Reports indicate that reprocessing can reduce medical waste by up to 30%, making it an attractive option for environmentally conscious institutions. This trend is likely to continue shaping the Medical Device Reprocessing Market.

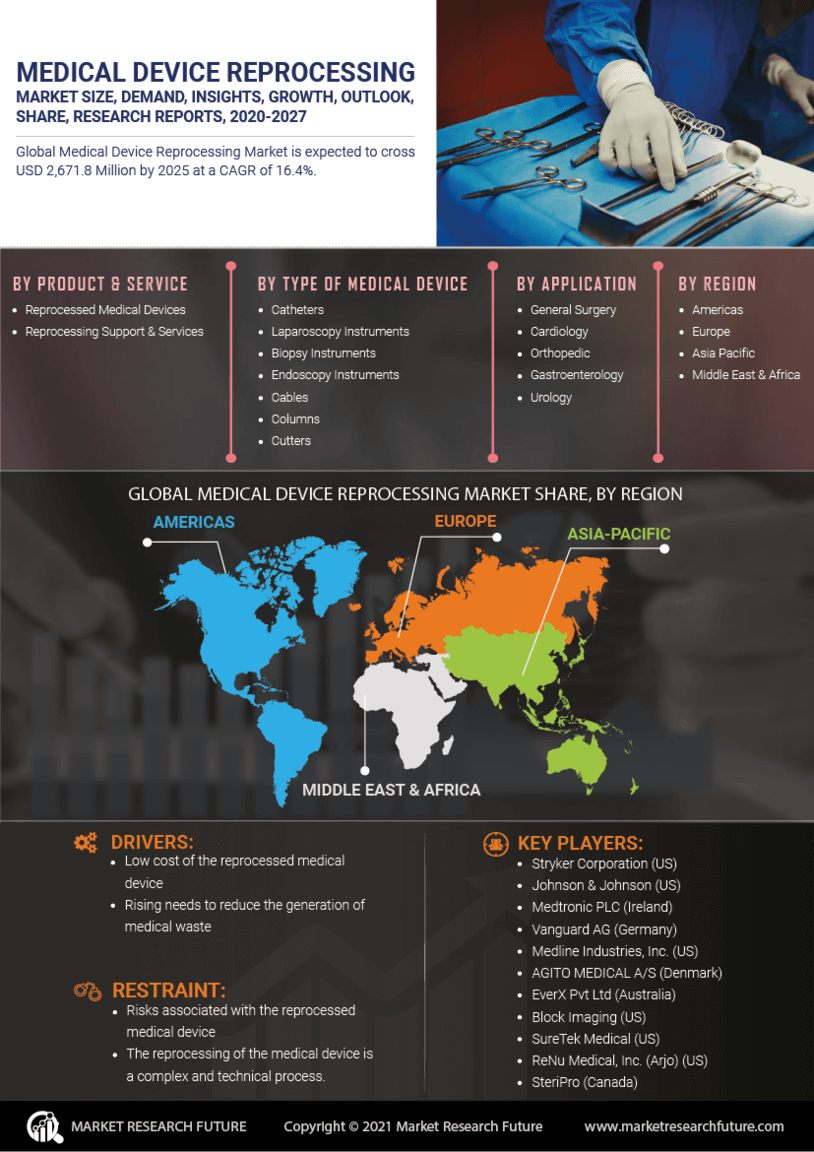

Cost Efficiency in Healthcare

The Medical Device Reprocessing Market is increasingly driven by the need for cost efficiency in healthcare systems. Hospitals and clinics are under constant pressure to reduce operational costs while maintaining high standards of patient care. Reprocessing medical devices offers a viable solution, as it significantly lowers the expenses associated with purchasing new devices. According to recent data, reprocessed devices can cost up to 50% less than their single-use counterparts. This financial incentive is compelling for healthcare providers, particularly in regions where budget constraints are prevalent. As a result, the adoption of reprocessing practices is likely to expand, contributing to the growth of the Medical Device Reprocessing Market.

Regulatory Support and Guidelines

Regulatory support is a crucial driver for the Medical Device Reprocessing Market. Governments and health authorities are increasingly recognizing the importance of reprocessing as a means to enhance healthcare efficiency and sustainability. Regulatory bodies are establishing guidelines that ensure the safety and effectiveness of reprocessed devices, which is essential for gaining the trust of healthcare providers and patients alike. The establishment of clear regulatory frameworks is likely to encourage more facilities to adopt reprocessing practices, thereby expanding the market. As regulations continue to evolve, they will play a significant role in shaping the future of the Medical Device Reprocessing Market.

Rising Demand for Healthcare Services

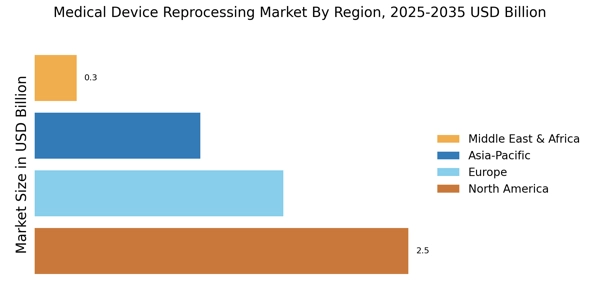

The Medical Device Reprocessing Market is experiencing growth due to the rising demand for healthcare services. As populations age and chronic diseases become more prevalent, the need for medical devices is increasing. This surge in demand places additional pressure on healthcare systems to manage costs effectively. Reprocessing medical devices presents a practical solution to meet this demand without compromising quality or safety. The market is projected to grow as healthcare facilities seek to balance the need for more devices with budgetary constraints. This trend indicates a promising future for the Medical Device Reprocessing Market, as it aligns with the evolving needs of healthcare providers.