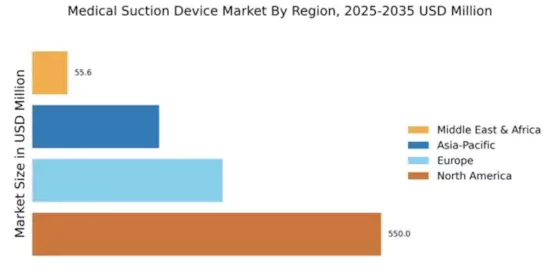

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the medical suction device market, holding a significant market share of 550.0 million. The region's growth is driven by increasing healthcare expenditures, technological advancements, and a rising prevalence of chronic diseases. Regulatory support from agencies like the FDA further catalyzes innovation and market expansion, ensuring compliance and safety in medical devices. The competitive landscape is robust, with key players such as Medtronic, Boston Scientific, and Stryker leading the charge. The U.S. remains the largest market, supported by a well-established healthcare infrastructure and high demand for advanced medical technologies. The presence of major manufacturers and ongoing R&D investments are expected to sustain growth in this region.

Europe : Emerging Market with Growth Potential

Europe's medical suction device market is valued at 300.0 million, reflecting a growing demand driven by an aging population and increasing surgical procedures. Regulatory frameworks, such as the Medical Device Regulation (MDR), are enhancing product safety and efficacy, thereby boosting consumer confidence and market growth. The region is also witnessing a shift towards minimally invasive surgeries, further propelling the demand for suction devices. Leading countries like Germany, the UK, and France are at the forefront of this market, with a strong presence of key players such as B. Braun and Fresenius Kabi. The competitive landscape is characterized by innovation and strategic partnerships, enabling companies to enhance their product offerings. The European market is expected to grow steadily as healthcare providers increasingly adopt advanced medical technologies.

Asia-Pacific : Rapidly Growing Healthcare Sector

The Asia-Pacific region, with a market size of 200.0 million, is rapidly emerging as a significant player in the medical suction device market. Factors such as increasing healthcare investments, a growing population, and rising awareness of advanced medical technologies are driving this growth. Additionally, government initiatives aimed at improving healthcare infrastructure are expected to further boost market demand in the coming years. Countries like Japan, China, and India are leading the charge, with a mix of local and international players competing for market share. Companies such as Olympus and ConvaTec are expanding their presence in this region, focusing on innovation and affordability. The competitive landscape is evolving, with a strong emphasis on meeting the unique needs of diverse patient populations across Asia-Pacific.

Middle East and Africa : Untapped Market with Opportunities

The Middle East and Africa (MEA) region, valued at 55.61 million, presents a unique opportunity in the medical suction device market. The growth is driven by increasing healthcare investments, a rising prevalence of chronic diseases, and a growing demand for advanced medical technologies. Regulatory bodies are beginning to establish frameworks that support the safe introduction of medical devices, which is crucial for market expansion. Countries like South Africa and the UAE are leading the market, with a growing number of healthcare facilities and increasing patient populations. The competitive landscape is characterized by a mix of local and international players, with companies like Hollister and Stryker looking to expand their footprint. As healthcare systems evolve, the MEA region is expected to see significant growth in the medical suction device market.