Cost Efficiency

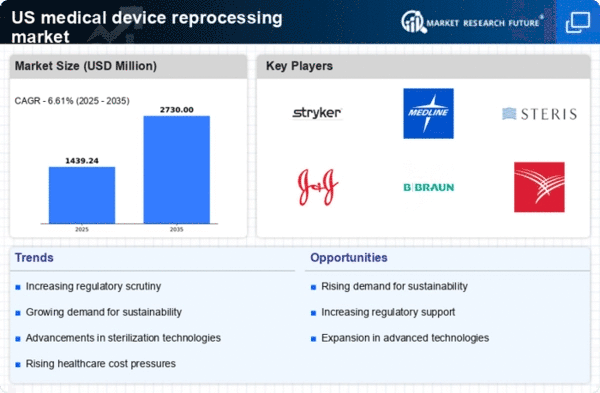

The US Medical Device Reprocessing Market is increasingly driven by the need for cost efficiency in healthcare. Hospitals and healthcare facilities are under constant pressure to reduce operational costs while maintaining high standards of patient care. Reprocessing medical devices offers a viable solution, as it can reduce costs by up to 50% compared to purchasing new devices. This financial incentive is particularly appealing in a landscape where healthcare budgets are constrained. As a result, many healthcare providers are adopting reprocessing practices to optimize their expenditures. The trend towards cost efficiency is likely to continue, as more institutions recognize the potential savings associated with reprocessed devices, thereby propelling the growth of the US Medical Device Reprocessing Market.

Regulatory Support

Regulatory support plays a crucial role in shaping the US Medical Device Reprocessing Market. The Food and Drug Administration (FDA) has established guidelines that facilitate the safe reprocessing of medical devices, thereby instilling confidence among healthcare providers. These regulations ensure that reprocessed devices meet stringent safety and efficacy standards, which is essential for their acceptance in clinical settings. As regulatory frameworks continue to evolve, they are likely to encourage more healthcare facilities to adopt reprocessing practices. This supportive regulatory environment is expected to enhance the credibility of reprocessed devices, further driving growth in the US Medical Device Reprocessing Market.

Technological Innovations

Technological innovations are significantly influencing the US Medical Device Reprocessing Market. Advances in sterilization techniques and materials science have improved the safety and effectiveness of reprocessed devices. New technologies enable the efficient cleaning, sterilization, and testing of medical devices, ensuring they meet the necessary safety standards. As these innovations continue to emerge, they are likely to enhance the appeal of reprocessed devices among healthcare providers. Furthermore, the integration of automation and data analytics in reprocessing operations can streamline processes, reduce costs, and improve overall efficiency. This technological evolution is expected to be a key driver of growth in the US Medical Device Reprocessing Market.

Environmental Sustainability

Environmental sustainability is becoming a pivotal driver in the US Medical Device Reprocessing Market. As awareness of environmental issues grows, healthcare organizations are increasingly seeking ways to minimize their ecological footprint. Reprocessing medical devices not only conserves resources but also reduces medical waste, which is a significant concern in the healthcare sector. The reprocessing of single-use devices can lead to a reduction of waste by millions of pounds annually. This commitment to sustainability aligns with broader societal trends towards eco-friendly practices, making it a compelling reason for healthcare providers to engage in reprocessing. Consequently, the emphasis on environmental sustainability is expected to bolster the US Medical Device Reprocessing Market in the coming years.

Increasing Demand for Healthcare Services

The increasing demand for healthcare services is a significant driver of the US Medical Device Reprocessing Market. As the population ages and the prevalence of chronic diseases rises, healthcare facilities are experiencing heightened pressure to provide quality care. This surge in demand necessitates the efficient use of medical devices, making reprocessing an attractive option. By reusing devices, healthcare providers can ensure a steady supply of necessary tools without incurring the high costs associated with new purchases. This trend is likely to continue, as the healthcare sector adapts to meet the growing needs of patients, thereby fostering the expansion of the US Medical Device Reprocessing Market.