Integration with Data Analytics

The integration of mass spectrometry with advanced data analytics is transforming the Mass Spectrometer Market. As the volume of data generated by mass spectrometers increases, the need for sophisticated data analysis tools becomes paramount. This integration allows for more efficient data interpretation, enabling researchers to derive actionable insights from complex datasets. The rise of artificial intelligence and machine learning in data processing is further enhancing the capabilities of mass spectrometers. Market analysis suggests that the adoption of data analytics in mass spectrometry could lead to a 15% increase in operational efficiency for laboratories. Consequently, this trend is likely to bolster the Mass Spectrometer Market, as organizations seek to leverage data-driven approaches to improve research outcomes and streamline workflows.

Growing Demand in Emerging Markets

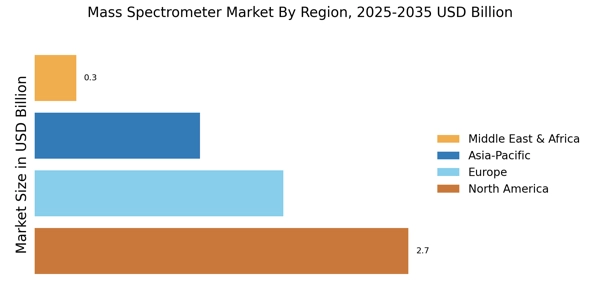

The Mass Spectrometer Market is witnessing a notable increase in demand from emerging markets, where industrialization and research activities are on the rise. Countries in Asia-Pacific and Latin America are investing heavily in scientific research and development, leading to a greater need for advanced analytical instruments. This trend is particularly evident in the pharmaceutical and biotechnology sectors, where mass spectrometry plays a critical role in drug development and quality control. Market data indicates that the Asia-Pacific region is expected to account for a significant share of the mass spectrometer market, with a projected growth rate of around 8% annually. This growing demand in emerging markets is likely to drive innovation and competition within the Mass Spectrometer Market, as manufacturers seek to cater to the unique needs of these regions.

Regulatory Compliance and Quality Control

The Mass Spectrometer Market is significantly influenced by the stringent regulatory requirements across various sectors, particularly in pharmaceuticals and food safety. Regulatory bodies mandate rigorous testing and quality control measures, necessitating the use of reliable analytical techniques such as mass spectrometry. This compliance ensures that products meet safety and efficacy standards, thereby driving the demand for mass spectrometers. Recent data indicates that the pharmaceutical sector alone accounts for over 40% of the mass spectrometer market, largely due to the need for compliance with Good Manufacturing Practices (GMP) and other regulations. As regulatory frameworks continue to evolve, the Mass Spectrometer Market is expected to expand, with manufacturers focusing on developing instruments that meet these stringent requirements.

Rising Applications in Clinical Diagnostics

The Mass Spectrometer Market is experiencing a surge in applications within clinical diagnostics, driven by the increasing need for accurate and rapid disease detection. Mass spectrometry is becoming an essential tool in identifying biomarkers and analyzing complex biological samples, which is crucial for personalized medicine. The growing prevalence of chronic diseases and the demand for early diagnosis are propelling the adoption of mass spectrometers in clinical laboratories. Market data suggests that the clinical diagnostics segment is projected to grow at a rate of 9% annually, reflecting the expanding role of mass spectrometry in healthcare. This trend indicates that the Mass Spectrometer Market will continue to evolve, with innovations aimed at enhancing diagnostic capabilities and improving patient outcomes.

Technological Advancements in Mass Spectrometry

The Mass Spectrometer Market is experiencing rapid technological advancements that enhance the capabilities and applications of mass spectrometers. Innovations such as high-resolution mass spectrometry and miniaturized devices are becoming increasingly prevalent. These advancements allow for improved sensitivity and accuracy, which are crucial for applications in pharmaceuticals, environmental monitoring, and food safety. The introduction of new ionization techniques and data analysis software further expands the potential of mass spectrometers. According to recent data, the market for mass spectrometers is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years, driven by these technological improvements. As a result, the Mass Spectrometer Market is likely to witness a surge in demand from various sectors, including clinical diagnostics and proteomics.