Research Methodology on Marine Interiors Market

This research report provides an extensive review of the global marine interior market. This report outlines the extensive and intricate research of the market using both primary and secondary data sources. Primary research involves interviews with industry experts, vendors, channel partners, market opinion leaders, end-users and consumer groups. Furthermore, secondary research is conducted by collecting data from various online databases such as company websites, governmental agencies, subscription-based databases, industry-sponsored surveys, associations, and news archive websites. These data sources are meticulously studied and analyzed to provide an accurate assessment of the Marine Interiors market.

Secondary Data Analysis

Secondary data analysis is conducted by collecting and studying relevant documents and sources of information such as government and private websites, industry reports and research papers, statistical databases, associations related to Marine Interiors, and associated companies in the industry. This study provides a broad overview of the dynamics and trends in the Marine Interiors market, such as recent developments, regional and global expansion plans of companies, technology advancements, and regulatory developments.

Primary Data Analysis

Primary data for this research is collected through interviews and surveys with major stakeholders such as market opinion leaders, vendors, industry experts, consumers, key suppliers and distributors. These stakeholders provide valuable insights into customer preferences, pricing and purchasing trends, competitive pressures, industry trends, and technological advancements.

Sampling and Data Collection

Using convenience sampling, a total of 200 respondents were interviewed across the globe. The respondents were selected from vendors, dealers, manufacturers, and other industry stakeholders. For the survey, an online questioning platform was used, and detailed questionnaires are designed to map customer behaviour, attitudes, and preferences. The survey instrument is designed to capture detailed customer insights and assess customer satisfaction levels. The survey consisted of both open and close-ended questions.

Data Analysis

Data from the primary and secondary sources were compiled and collated, and subsequently, statistical tools such as MS Excel and SPSS were used for exhaustive data analysis. The data are analyzed to arrive at key market trends, drivers, inhibitors, and growth opportunities.

Results and Summary

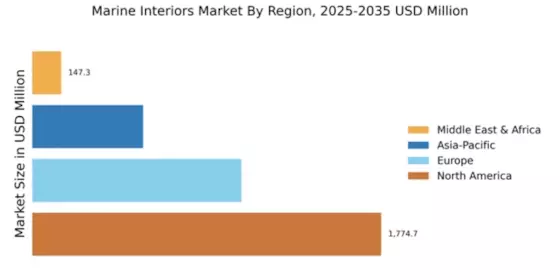

The analysis of the collected data revealed a surge in the demand for, and usage of, marine interiors across the globe, thereby increasing the overall applications of the product. The market is expected to witness a steady CAGR during the forecast period 2023 to 2030, due to the growing adoption of marine interiors in commercial, naval, and leisure vessels. In terms of region, Asia-Pacific is expected to have the highest market share due to the presence of a large marine industry and an increase in shipbuilding activities.

The market is also driven by the introduction of technologically advanced and safer materials, such as lightweight and fireproof materials, for marine interiors. The major players in the market are focusing on strategies such as mergers, acquisitions, and collaborations to enhance their market presence in the global marine interior market. This is expected to drive the market growth during the forecast period to 2030.