North America : Market Leader in MRO Services

North America continues to lead the Aircraft Cabin and Interiors MRO Services Market, holding a significant share of 2.6 billion. The region's growth is driven by a robust aviation sector, increasing air travel demand, and stringent safety regulations. Regulatory bodies are emphasizing compliance with safety standards, which further propels the need for MRO services. The presence of major airlines and OEMs enhances the market's resilience and growth potential.

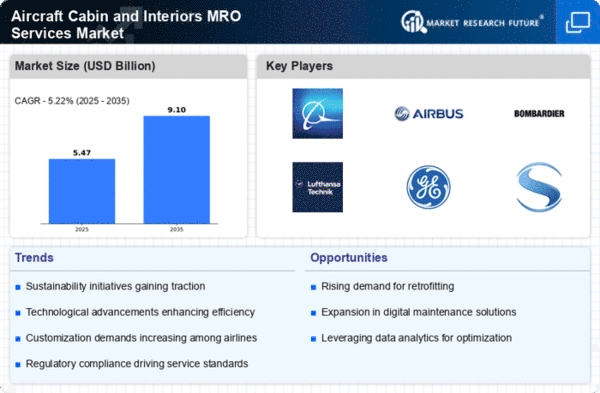

The competitive landscape in North America is characterized by key players such as Boeing, GE Aviation, and Rockwell Collins. These companies are investing in advanced technologies and sustainable practices to enhance service offerings. The U.S. market is particularly strong, supported by a large fleet of commercial and private aircraft. The ongoing modernization of aircraft interiors and the push for enhanced passenger experiences are also significant growth drivers in this region.

Europe : Emerging Market with Growth Potential

Europe's Aircraft Cabin and Interiors MRO Services Market is valued at 1.5 billion, reflecting a growing demand driven by increasing air traffic and regulatory support. The European Union Aviation Safety Agency (EASA) has been proactive in establishing regulations that enhance safety and efficiency in MRO operations. This regulatory framework is crucial for maintaining high standards in aircraft maintenance, thereby boosting market growth.

Leading countries in this region include Germany, France, and the UK, where companies like Airbus and Lufthansa Technik are prominent. The competitive landscape is evolving, with a focus on innovation and sustainability. The presence of established players and a growing number of MRO service providers contribute to a dynamic market environment, positioning Europe as a key player in the global MRO landscape.

Asia-Pacific : Rapidly Growing Aviation Hub

The Asia-Pacific region, valued at 0.9 billion, is witnessing rapid growth in the Aircraft Cabin and Interiors MRO Services Market. This surge is attributed to increasing air travel, expanding airline fleets, and rising passenger expectations for comfort and safety. Governments in the region are also investing in aviation infrastructure, which supports the growth of MRO services. Regulatory bodies are focusing on enhancing safety standards, which further drives demand for maintenance services.

Countries like China, India, and Japan are leading the charge in this market. The competitive landscape features both established players and emerging companies, with significant investments in technology and innovation. Key players such as Bombardier and Thales Group are actively expanding their service offerings to meet the growing demand, positioning the region as a vital player in The Aircraft Cabin and Interiors MRO Services.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of 0.2 billion, presents unique growth opportunities in the Aircraft Cabin and Interiors MRO Services Market. The region is experiencing a rise in air travel, driven by tourism and business travel, which is expected to boost demand for MRO services. However, challenges such as regulatory hurdles and infrastructure limitations persist. Governments are increasingly recognizing the importance of aviation safety, which is catalyzing investments in MRO capabilities.

Leading countries in this region include the UAE and South Africa, where local players are beginning to establish a foothold in the MRO sector. The competitive landscape is evolving, with both local and international companies vying for market share. The presence of key players like Safran and MRO Holdings indicates a growing interest in enhancing service offerings to meet regional demands, despite the challenges faced.