Focus on Sustainable Practices

Sustainability is becoming increasingly important in the Maraging Steel Market, as manufacturers seek to reduce their environmental impact. The production of maraging steel involves processes that can be optimized for energy efficiency and waste reduction. Companies are investing in greener technologies and practices, such as recycling scrap metal and utilizing renewable energy sources in their operations. This shift towards sustainability not only aligns with global environmental goals but also appeals to consumers and businesses that prioritize eco-friendly materials. As a result, the Maraging Steel Market is likely to see a rise in demand for sustainably produced maraging steel, which could enhance the competitive edge of manufacturers who adopt these practices.

Growth in Automotive Applications

The automotive industry is increasingly recognizing the advantages of maraging steel, particularly in high-performance applications. The Maraging Steel Market is benefiting from the trend towards lightweight materials that do not compromise on strength or safety. As automotive manufacturers strive to improve fuel efficiency and reduce emissions, the use of maraging steel in components such as chassis and suspension systems is becoming more prevalent. Market analysis indicates that the automotive sector is expected to contribute significantly to the growth of the maraging steel market, with a projected increase in demand of approximately 4% annually. This trend suggests that the Maraging Steel Market will continue to evolve as automotive technologies advance and the need for high-performance materials intensifies.

Emerging Markets and Economic Growth

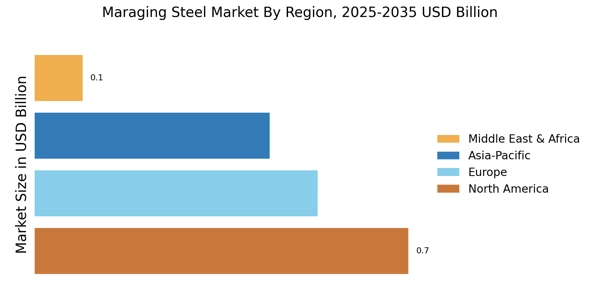

Emerging markets are playing a crucial role in the expansion of the Maraging Steel Market. As economies in regions such as Asia and South America continue to grow, there is an increasing demand for high-performance materials across various industries, including construction, aerospace, and automotive. The rise of manufacturing capabilities in these regions is likely to drive the consumption of maraging steel, as local industries seek to enhance their product offerings. Furthermore, government initiatives aimed at boosting industrial growth and infrastructure development are expected to further stimulate demand for maraging steel. This trend indicates that the Maraging Steel Market may experience robust growth opportunities in emerging markets, potentially reshaping the competitive landscape.

Rising Demand in Aerospace and Defense

The aerospace and defense sectors are driving a substantial increase in the demand for maraging steel, which is renowned for its exceptional strength and toughness. The Maraging Steel Market is witnessing a surge in applications for components such as aircraft landing gear, missile casings, and structural parts due to the material's ability to withstand extreme conditions. According to industry reports, the aerospace sector alone is projected to account for a significant share of the maraging steel market, with an expected growth rate of over 5% annually. This rising demand is further fueled by the ongoing advancements in aerospace technologies, which require materials that can offer both high performance and reliability. Consequently, the Maraging Steel Market is poised for growth as manufacturers respond to the needs of these critical sectors.

Technological Advancements in Manufacturing

The Maraging Steel Market is experiencing a notable transformation due to advancements in manufacturing technologies. Innovations such as additive manufacturing and precision casting are enhancing the production processes of maraging steel, leading to improved material properties and reduced production costs. These technologies allow for the creation of complex geometries that were previously unattainable, thereby expanding the application range of maraging steel in various sectors. As a result, manufacturers are increasingly adopting these advanced techniques to meet the growing demand for high-performance materials. The integration of automation and digitalization in manufacturing processes is also streamlining operations, which could potentially lead to a more efficient supply chain in the Maraging Steel Market.