Managed Network Services Market Summary

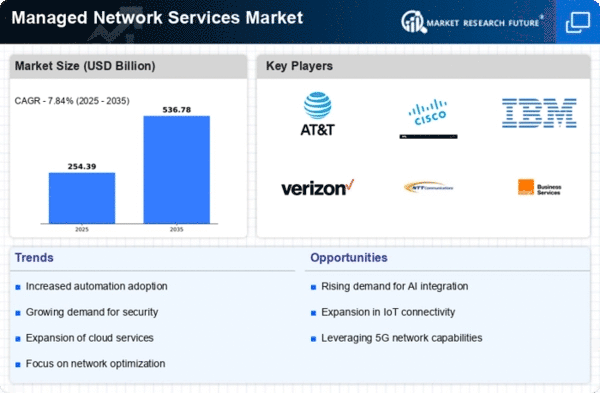

As per MRFR analysis, the Managed Network Services Market Size was estimated at 235.9 USD Billion in 2024. The Managed Network Services industry is projected to grow from 252.34 USD Billion in 2025 to 536.78 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.84 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Managed Network Services Market is experiencing robust growth driven by technological advancements and evolving customer needs.

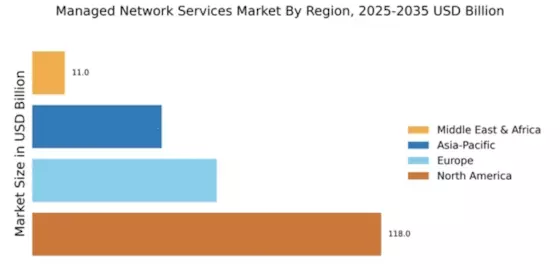

- North America remains the largest market for managed network services, driven by increasing demand for advanced network solutions.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid digital transformation and cloud adoption.

- Network security continues to dominate as the largest segment, while cloud services are recognized as the fastest-growing segment in the market.

- Key drivers include the growing demand for network scalability and the emphasis on cost efficiency, which are shaping service offerings.

Market Size & Forecast

| 2024 Market Size | 235.9 (USD Billion) |

| 2035 Market Size | 536.78 (USD Billion) |

| CAGR (2025 - 2035) | 7.84% |

Major Players

AT&T (US), Cisco Systems (US), IBM (US), Verizon Communications (US), NTT Communications (JP), Orange Business Services (FR), BT Group (GB), Tata Communications (IN), Lumen Technologies (US)