Market Share

Managed Network Services Market Share Analysis

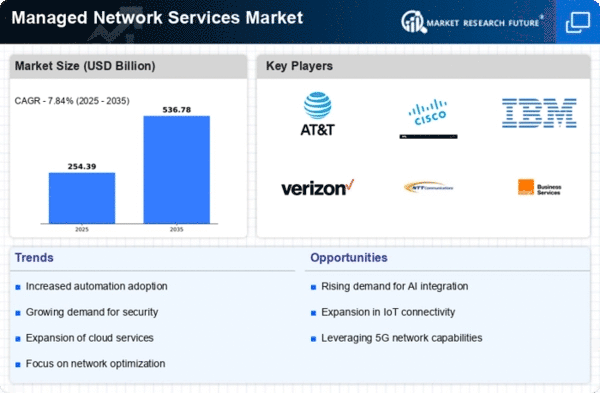

Inside the powerful domain of data innovation, the MNS area has arisen as a critical member in empowering smoothed out and successful business exercises. The serious rivalry in this industry has constrained organizations to execute an assortment of piece of the pie situating procedures. A broadly embraced technique is separation, in which associations endeavour to separate their administrations from those of their opponents. This might involve giving unmistakable properties, specific information, or tweaked goals to address specific client necessities. Thusly, organizations can draw in clients looking for a novel assortment of administrations and cut out a specialty for themselves. An extra basic methodology relates to cost initiative. A few MNS suppliers focus on the improvement of functional efficiencies and cost structures as a way to achieve a significant piece of the pie. This essential methodology enables these suppliers to offer their administrations at a more cutthroat cost range. Clients looking to streamline their venture while keeping up with the best expectations of organization the executives’ administrations might find this monetary arranged system particularly alluring. Besides, certain organizations use economies of scale to decrease costs, empowering them to keep up with productivity while offering cutthroat valuing structures. With regards to determining the position of a company in the MNS market, strategic alliances & partnerships are decisive. Strategic alliances with the providers of complementary service or collaborations with eminent industry players can be utilized for investigating new development opportunities. These cooperative alliances have the potential to penetrate new markets, improve technical capabilities, or broaden the scope of services offered. By exploiting the capacities and assets of their colleagues, MNS suppliers can set up a good foundation for themselves as suppliers of complete arrangements fit for meeting the fluctuated necessities of their clients by using their aggregate mastery. Besides, in the MNS industry, growing and getting piece of the pie are worked with by client driven procedures. With regards to guaranteeing consumer loyalty, MNS suppliers often focus on the accompanying: proactive upkeep, customized arrangements, and powerful help administrations. An overjoyed customers is leaned to execute contract recharges as well as expect the job of a promoter, in this way creating great verbal exchange suggestions. This technique develops client dedication as well as works with the procurement of new clients, given the developing accentuation that associations put on client connections and administration quality while picking an MNS specialist co-op. In the unique MNS industry, piece of the pie situating is vigorously dependent on dexterity and development. An upper hand builds to organizations that can quickly conform to new advancements and industry patterns. MNS suppliers should exhibit their ability to keep an upper hand by carrying out mechanical technology, mechanization, man-made brainpower, or modern examination. Through a pledge to continuous development and the arrangement of cutting-edge arrangements, associations can lay down a good foundation for themselves as moderate leaders in their separate areas, subsequently interesting to customer base looking for partners who have the capacity to explore the complicated difficulties of the computerized age.

Leave a Comment