Research Methodology on Lingerie Market

The research study on the lingerie market is conducted using rigorous primary and secondary market research. Primary and secondary research is carried out to gain a complete understanding of the market, industry trends, and competitive landscape. Additionally, interviews and opinions of experts are included so that more detailed and comprehensive information is gathered. Furthermore, data collected from Third parties are validated through our interview process to get a stand on the market size, structure and trends.

Primary Research

The primary research process entailed gathering information through telephonic interviews and direct contact with the various market participants to gain insight into the lingerie market. Also, research is conducted via survey-based interviews and analysis of their responses. Additionally, interviews are conducted with industry professionals to better understand their perspectives on the market. Furthermore, primary research includes in-depth interviews with key opinion leaders, boutiques, and retailers, as well as industry consultants, organizations, forums, alliances, and some of the major participants operating in the lingerie market. Interviews provide in-depth information about the competitive landscape, market trends, general market dynamics and the size of the market. Moreover, a primary survey is conducted through the use of structured questionnaires which are carried out using a predetermined set of questions to assess vendors' responses in detail.

Secondary Research

Secondary research is conducted to gain a comprehensive understanding of the global lingerie market which is conducted via extensive secondary sources, such as Hoovers, Bloomberg, Businessweek, Factiva, Allied Market Research, MarketWatch, The Economist, Annual Reports and White Papers. Other sources include scholarly journals and directories such as Annual Reports of companies, financial reports and other publications related to the lingerie market.

Sources

The overall industry structure is determined by collecting data from industry associations such as the American Apparel Producers Network (AAPN), Business Network International (BNI), International Apparel Federation (IAF), and the American Apparel and Footwear Association (AAFA), and various government and private agencies. State population data such as demographics, economic indicators, and apparel manufacturing structure were obtained from various government agencies such as the United States Bureau of Labor Statistics (BLS), Center for Urban Policy Research and Analysis (CUPR), American Apparel and Footwear Association (AAFA), and United States Department of Labor (DOL). Furthermore, the financial information of listed players has been collected from their respective websites, annual reports, and research papers. Market size, which is the combination of value and volume is determined based on overall regional segments, product type and application.

Tools & Model

This report uses a combination of both quantitative and qualitative techniques for market size estimation and forecasting. Research studies by both primary and secondary sources are incorporated into the models for market size estimation. The top-down and bottom-up approaches are used for estimating the overall market size. The data points such as regional market shares, split by different segments and country-level breakdown are considered while generating the market estimates. These estimates are validated through primary interviews with key industry participants. Whereas, company-level information is acquired via secondary sources and verified/validated through primary sources.

The key players covered in the report include Wacoal Corporation, Maidenform Brands, Inc., Triumph International Corporation, PARFUME DE MODE SRL, Tefron Ltd., Aimer, Lise Charmel SAS, Boux Avenue, Oysho and others. Furthermore, the report has considered key vendor strategies and their impact on the market. Company profiles are included in the report, which helps in understanding the structure of the market and strategies.

Data triangulation

The market information from both primary and secondary sources was triangulated to gain accurate and precise market size and forecast. Research studies from source publications are used for validating the data as well as for market size estimation. Data triangulation is used to confirm market size, revenue, industry trends, and other critical market parameters.

Market Share Analysis

The market share analysis of the key players is studied by analyzing their strategies such as product launches, product developments, agreements, partnerships, collaborations, and mergers & acquisitions and their share of the total lingerie market.

Conclusion

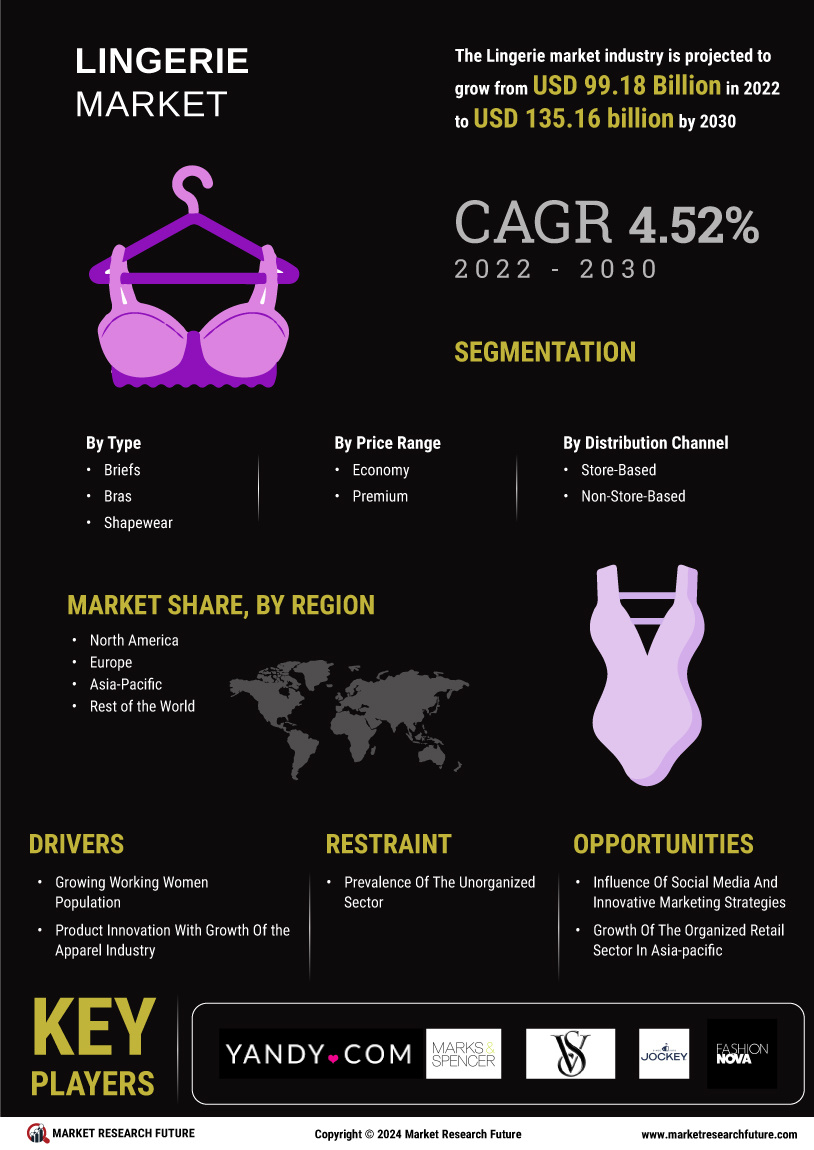

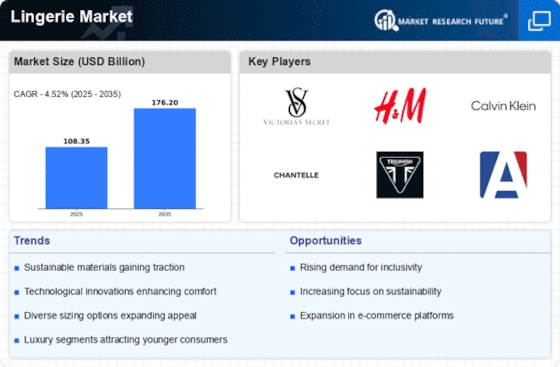

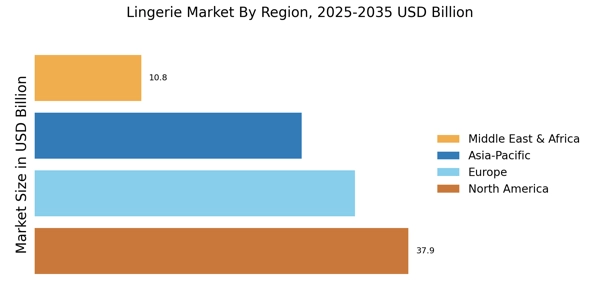

This report provides a comprehensive overview of the lingerie market, including market segmentation, competitive analysis, trends, production, consumption and size. Moreover, this report also covers the various dynamics of the market, such as drivers, restraints and opportunities in the coming years. Furthermore, this report includes a detailed analysis of the key players and their strategies in the market. It also provides an in-depth analysis of the industry structure, market size, market share, growth prospects and key success factors. The report also provides an assessment of the market and the industry potential, along with recommendations for the stakeholders in the global lingerie market.

The report also provides a 7-year outlook for the lingerie market in terms of value and provides an insight into the competitive landscape and the current trends prevalent in the said market segment. The primary and secondary research conducted for this report presents a comprehensive assessment of the market and offers market intelligence in terms of growth, progress, production and more. Furthermore, this report includes detailed information on the industry structure and the competitive landscape which provides a comprehensive analysis of the market scenario.