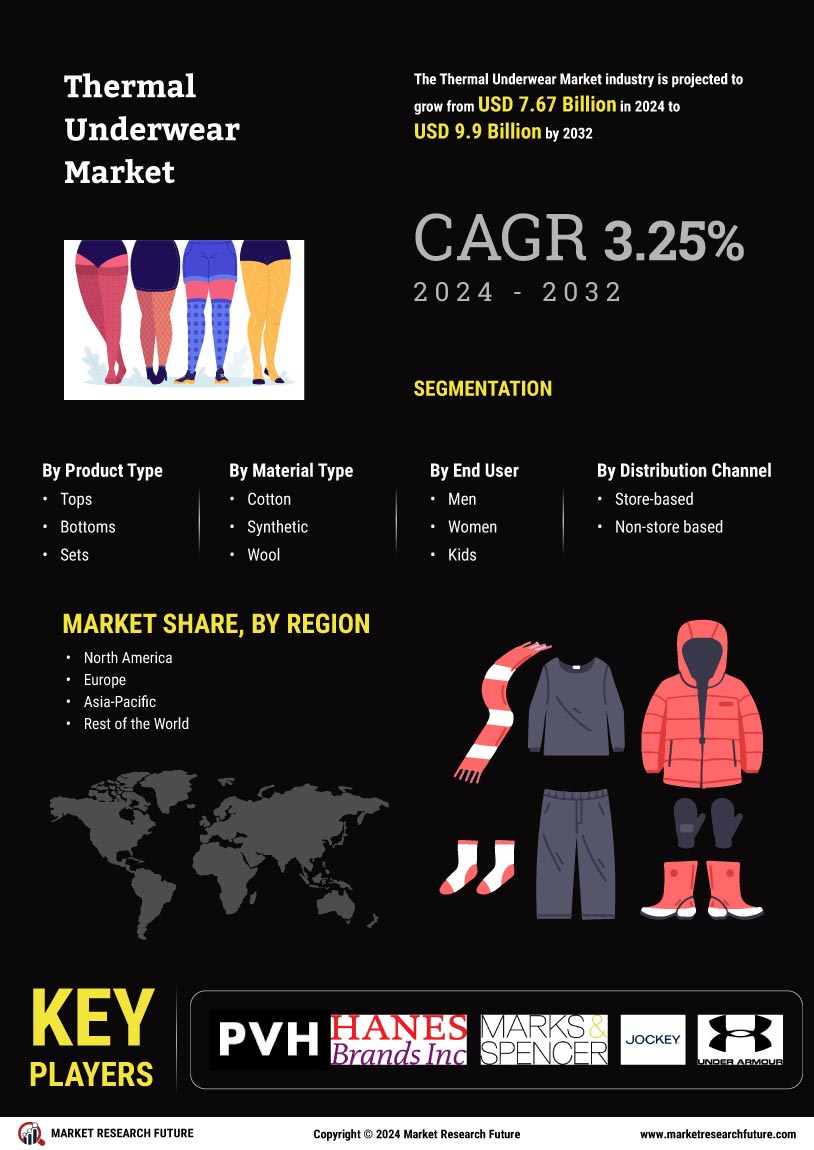

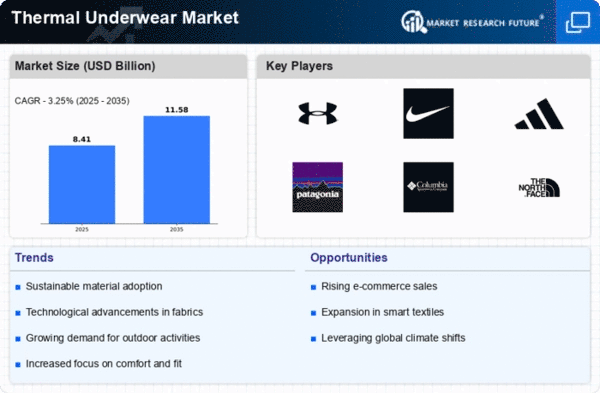

Market Growth Projections

The Global Thermal Underwear Industry is poised for substantial growth, with projections indicating a market size of 8.15 USD Billion in 2024 and an anticipated increase to 11.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 3.25% from 2025 to 2035. Various factors contribute to this upward trend, including rising consumer awareness, technological advancements, and the expansion of e-commerce platforms. The market's resilience in adapting to changing consumer preferences and the ongoing demand for functional thermal wear further solidify its potential for sustained growth in the coming years.

Expansion of E-commerce Platforms

The Global Thermal Underwear Industry is significantly impacted by the expansion of e-commerce platforms. Online shopping offers consumers greater access to a variety of thermal wear options, allowing for informed purchasing decisions based on reviews and product comparisons. This shift towards digital retail is particularly advantageous for niche brands that specialize in thermal apparel, as they can reach a global audience without the constraints of traditional retail. The convenience of online shopping, coupled with targeted marketing strategies, is likely to enhance market penetration. As e-commerce continues to grow, it may play a crucial role in the projected market growth to 11.6 USD Billion by 2035.

Rising Demand for Outdoor Activities

The Global Thermal Underwear Industry experiences a notable increase in demand driven by the growing popularity of outdoor activities. As more individuals engage in hiking, skiing, and other winter sports, the need for effective thermal wear becomes paramount. In 2024, the market is projected to reach 8.15 USD Billion, reflecting a shift towards performance-oriented apparel. This trend is particularly evident in regions with colder climates, where thermal underwear is essential for comfort and protection against the elements. The emphasis on outdoor lifestyles suggests that the market will continue to expand as consumers prioritize functionality and warmth in their clothing choices.

Technological Advancements in Fabric

Innovations in fabric technology significantly influence the Global Thermal Underwear Industry. The introduction of moisture-wicking, breathable, and lightweight materials enhances the performance of thermal underwear, making it more appealing to consumers. For instance, advancements in synthetic fibers and blends allow for better insulation without compromising comfort. This technological evolution not only caters to the needs of athletes but also attracts a broader audience seeking everyday warmth. As these innovations proliferate, they are likely to contribute to the market's growth, with projections indicating a rise to 11.6 USD Billion by 2035, showcasing the potential for sustained consumer interest.

Increased Awareness of Health and Wellness

The Global Thermal Underwear Industry benefits from a heightened awareness of health and wellness among consumers. As individuals become more conscious of their health, they seek clothing that supports their well-being, particularly in colder climates. Thermal underwear is perceived as a means to maintain body temperature and prevent illnesses related to cold exposure. This trend is evident in the growing sales of thermal wear, as consumers prioritize products that offer both comfort and health benefits. The market's growth trajectory, with a projected CAGR of 3.25% from 2025 to 2035, suggests that this awareness will continue to drive demand for thermal apparel.

Diverse Consumer Preferences and Customization

The Global Thermal Underwear Industry is characterized by diverse consumer preferences, leading to a demand for customized thermal wear. As consumers seek products that cater to their specific needs, brands are increasingly offering tailored options in terms of fit, style, and functionality. This trend is particularly evident among younger demographics who prioritize individuality in their clothing choices. The ability to customize thermal underwear not only enhances consumer satisfaction but also fosters brand loyalty. As the market adapts to these preferences, it is likely to see sustained growth, contributing to the overall expansion of the industry.