Health and Safety Regulations

Stringent health and safety regulations are becoming a significant driver for the Lidding Films Market. Governments and regulatory bodies are enforcing guidelines that require food packaging to meet specific safety standards. This has led to an increased demand for high-quality lidding films that comply with these regulations. The market is witnessing a shift towards materials that are not only safe for food contact but also capable of providing tamper-evident features. As the focus on food safety intensifies, the Lidding Films Market is likely to see a surge in demand for compliant packaging solutions.

Rising Demand for Packaged Foods

The increasing consumer preference for packaged foods is a primary driver of the Lidding Films Market. As lifestyles become busier, consumers are gravitating towards convenient meal options that require minimal preparation. This trend is reflected in the growth of the packaged food sector, which has been projected to reach a valuation of approximately 3 trillion USD by 2025. Lidding films play a crucial role in preserving the freshness and extending the shelf life of these products, thereby enhancing their appeal. The Lidding Films Market is likely to benefit from this trend, as manufacturers seek innovative packaging solutions that cater to the evolving demands of consumers.

Consumer Awareness of Sustainability

There is a growing consumer awareness regarding sustainability and environmental impact, which is influencing the Lidding Films Market. As consumers become more conscious of their purchasing decisions, they are favoring products that utilize eco-friendly packaging. This shift is prompting manufacturers to explore sustainable materials for lidding films, such as plant-based polymers and recyclable options. The market for sustainable packaging is expected to grow significantly, with projections indicating a potential increase of 20% by 2025. This trend is likely to reshape the Lidding Films Market, as companies adapt to meet the changing preferences of environmentally conscious consumers.

Technological Innovations in Packaging

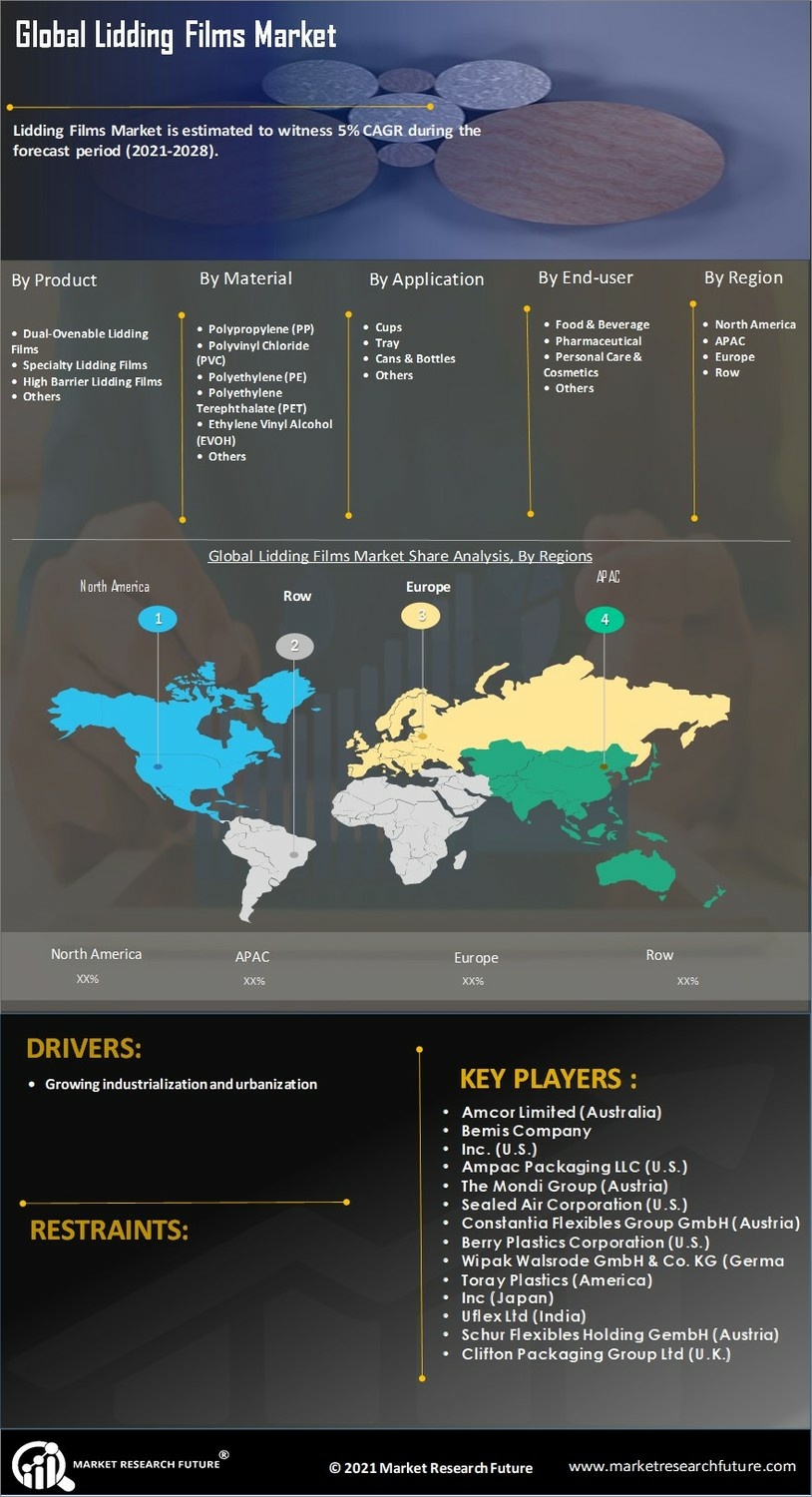

Technological advancements in packaging materials and processes are significantly influencing the Lidding Films Market. Innovations such as the development of biodegradable lidding films and enhanced barrier properties are gaining traction. These advancements not only improve product preservation but also align with sustainability goals. The market for lidding films is expected to grow at a compound annual growth rate of around 5% through 2025, driven by these technological improvements. As companies invest in research and development, the Lidding Films Market is poised for transformation, offering more efficient and environmentally friendly packaging solutions.

Growth of E-commerce and Online Food Delivery

The rapid expansion of e-commerce and online food delivery services is reshaping the Lidding Films Market. As consumers increasingly turn to online platforms for grocery shopping and meal delivery, the demand for effective packaging solutions rises. Lidding films are essential for ensuring that food products remain intact and fresh during transit. The online food delivery market is projected to surpass 200 billion USD by 2025, indicating a substantial opportunity for the Lidding Films Market. This growth necessitates innovative packaging that meets the logistical challenges of e-commerce, further driving market demand.