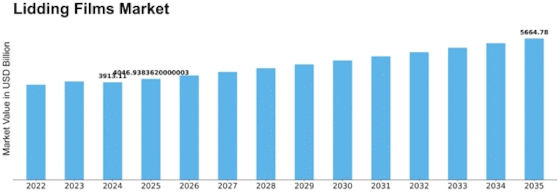

Lidding Films Size

Lidding Films Market Growth Projections and Opportunities

The lidding films market is influenced by various factors that contribute to its growth, demand, and overall industry dynamics.

Rise in Convenience Packaging: The growing demand for convenient packaging solutions, driven by busy lifestyles and on-the-go consumption habits, is a significant factor fueling the lidding films market. Lidding films offer easy-to-use, peelable seals that provide quick access to packaged products, making them ideal for single-serve and portion-controlled packaging formats. As consumers increasingly prioritize convenience, the demand for lidding films in the food, beverage, and personal care industries is expected to rise.

Shift Towards Sustainable Packaging: With increasing awareness of environmental issues and regulations regarding plastic waste, there is a growing emphasis on sustainable packaging solutions. Lidding films made from recyclable, compostable, or biodegradable materials offer eco-friendly alternatives to traditional packaging materials. As governments and consumers push for sustainable practices, the demand for environmentally friendly lidding films is projected to increase, driving market growth.

Advancements in Barrier Technologies: Barrier properties are crucial for extending the shelf life and preserving the freshness of packaged products, particularly in the food and pharmaceutical industries. Manufacturers are investing in advanced barrier technologies to enhance the barrier performance of lidding films, such as oxygen, moisture, and aroma barriers. High-barrier lidding films help prevent spoilage, maintain product quality, and extend product shelf life, making them essential for perishable and sensitive products.

Increasing Demand in Food Packaging: The food packaging industry is a major consumer of lidding films, driven by factors such as population growth, urbanization, and changing dietary habits. Lidding films are used in various food packaging applications, including fresh produce, dairy products, ready-to-eat meals, and snacks. With the rising demand for convenience foods, pre-packaged meals, and on-the-shelf freshness, the demand for lidding films in the food packaging sector is expected to grow steadily.

Growing Preference for Extended Shelf Life: Consumers seek products with longer shelf life, reduced food waste, and improved product quality. Lidding films with advanced barrier properties help extend the shelf life of packaged products by protecting them from external factors such as moisture, oxygen, light, and microbial contamination. The demand for lidding films that offer enhanced shelf life and product protection is driven by consumer preferences for fresh, safe, and high-quality products.

Expansion of Pharmaceutical Packaging: The pharmaceutical industry relies on lidding films for packaging unit doses, blister packs, and pharmaceutical products. Lidding films provide tamper-evident seals, protection against contamination, and barrier properties to maintain the efficacy and stability of pharmaceutical formulations. With the increasing demand for pharmaceuticals, especially in emerging markets, the demand for lidding films in pharmaceutical packaging applications is expected to grow.

Regulatory Compliance: Regulatory standards and quality requirements governing packaging materials influence market dynamics in the lidding films industry. Compliance with regulations such as FDA approvals, EU directives, and food contact safety standards is essential for lidding film manufacturers to ensure product safety, quality, and market acceptance. Adherence to regulatory requirements builds trust and confidence among customers and helps manufacturers stay competitive in the market.

Innovations in Printing and Labeling: Printing and labeling technologies play a crucial role in enhancing the visual appeal and brand identity of packaged products. Lidding films offer excellent printability, enabling vibrant graphics, logos, and product information to be displayed on the packaging surface. Manufacturers are investing in digital printing, holographic effects, and smart labeling technologies to differentiate their products and attract consumers' attention, driving market demand for premium lidding films.

Market Segmentation and Customization: The lidding films market is segmented based on material type, sealing mechanism, application, end-user industry, and geography. Different materials such as polyethylene, polypropylene, polyester, and aluminum are used to manufacture lidding films for specific packaging requirements. Market segmentation allows manufacturers to tailor lidding films to different industries and applications, catering to diverse customer needs and preferences.

Competitive Landscape: The lidding films market is characterized by intense competition among global players, regional manufacturers, and niche suppliers. Competitive factors such as product quality, performance, pricing, and customer service influence market positioning and market share. Established companies invest in research and development to innovate new materials, technologies, and packaging formats, gaining a competitive edge in the lidding films market.

Leave a Comment