Licensed Sports Merchandise Market Summary

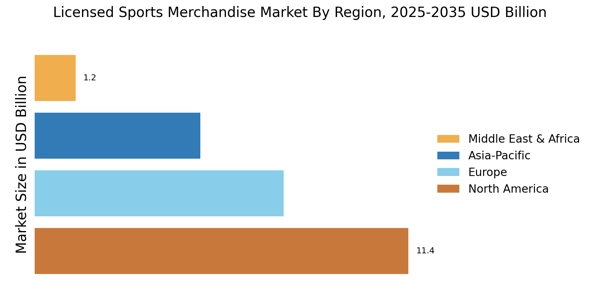

As per Market Research Future analysis, the Licensed Sports Merchandise Market was estimated at 25.22 USD Billion in 2024. The Licensed Sports Merchandise industry is projected to grow from 26.57 USD Billion in 2025 to 44.85 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.37% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Licensed Sports Merchandise Market is experiencing robust growth driven by digital engagement and evolving consumer preferences.

- Digital engagement and e-commerce growth are reshaping the purchasing landscape in the Licensed Sports Merchandise Market.

- Sustainability and ethical practices are becoming increasingly important to consumers, influencing brand loyalty and purchasing decisions.

- Customization and personalization are gaining traction, particularly in the apparel segment, which remains the largest market segment.

- Rising popularity of sports events and the influence of celebrity athletes are key drivers propelling market expansion in North America and Asia-Pacific.

Market Size & Forecast

| 2024 Market Size | 25.22 (USD Billion) |

| 2035 Market Size | 44.85 (USD Billion) |

| CAGR (2025 - 2035) | 5.37% |

Major Players

Nike (US), Adidas (DE), Fanatics (US), Under Armour (US), Puma (DE), Reebok (GB), New Era Cap (US), Majestic Athletic (US), Mitchell & Ness (US)