Leavening Agents Size

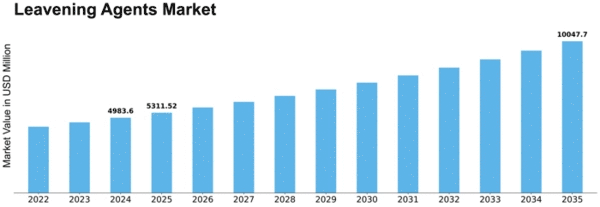

Leavening Agents Market Growth Projections and Opportunities

The Leavening Agents Market is growing because more and more people want ready-to-eat foods. More people want leavening agents because they want meals that are easier to make and take less time, all around. Like, leavening products are very important in the baking business for making light and fluffy baked goods. Clients are happy because they get tasty candies. The business is also growing because more and more people are baking at home. This is due in part to online groups and famous cooks.

The market for leavening products is also affected by the rules and regulations that are in place. People who buy this get more than they want. For food safety, the government has strict rules and quality standards. This is why it is very important that food is made with leavening products that are known to be safe. When companies make things, they need to follow these rules so that the market values reliability and the right way to use things. Because of government rules and customers who care about their health, companies spend money on research and development to come up with new leavening agents.

The market for leavening products is affected by the world economy in a big way. In the end, the price of leavening agents could change because of things like changes in exchange rates, changes in trade limits, and wars in other countries. These things have an effect on the costs of raw materials and shipping, which in turn have an effect on the total cost of production. To stay competitive and keep prices stable, manufacturers need to get past these market issues. What people buy could also have an effect on the market. People value things more highly when they are scarce or cost less.

How much technology has changed things is another important thing to think about in the leavening agent market. Leavening agents can work better and last longer if the way food is handled and the things that are used change. One part of this is coming up with new leavening agents for people who have to follow certain diets, like those who want gluten-free or organic choices. When a business opens up to new technologies, it can give more goods, go after special markets, and get more users.

Leave a Comment