Growing Focus on Patient-Centric Care

The Laboratory Information Systems Market is increasingly aligning with the trend towards patient-centric care. Healthcare providers are recognizing the importance of delivering personalized services, which necessitates the efficient management of laboratory data. Laboratory Information Systems Market that enable seamless communication between laboratories and healthcare providers are becoming essential. This shift towards patient-centric models is expected to drive the demand for systems that enhance data accessibility and improve patient outcomes. As healthcare organizations prioritize patient engagement, the Laboratory Information Systems Market is likely to see a rise in solutions that support these objectives.

Expansion of Healthcare Infrastructure

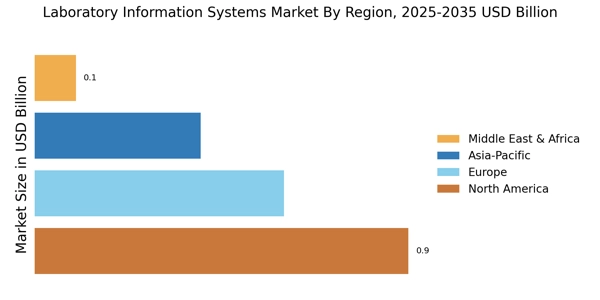

The Laboratory Information Systems Market is benefiting from the ongoing expansion of healthcare infrastructure. As new healthcare facilities are established, there is a corresponding need for advanced laboratory information systems to support their operations. This expansion is particularly evident in emerging markets, where investments in healthcare are increasing. The Laboratory Information Systems Market is projected to grow as these new facilities seek to implement efficient systems that enhance laboratory management and data handling. The demand for integrated solutions that streamline laboratory processes is likely to drive innovation and competition within the Laboratory Information Systems Market.

Advancements in Data Analytics and Reporting

The Laboratory Information Systems Market is witnessing advancements in data analytics and reporting capabilities. Laboratories are increasingly leveraging data analytics to derive insights from test results, which can inform clinical decisions and improve operational efficiency. The integration of advanced reporting features within Laboratory Information Systems Market is becoming a key differentiator in the market. As laboratories seek to enhance their analytical capabilities, the demand for systems that offer sophisticated data visualization and reporting tools is expected to grow. This trend indicates a shift towards data-driven decision-making within the Laboratory Information Systems Market.

Rising Demand for Automation in Laboratories

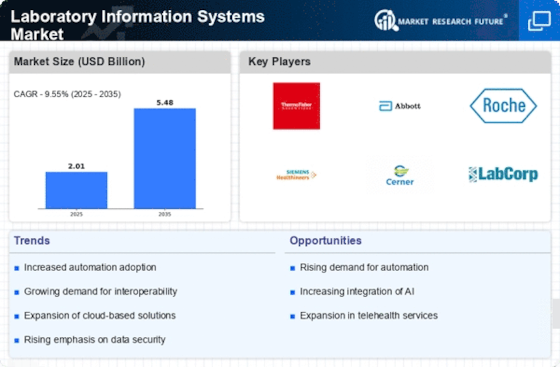

The Laboratory Information Systems Market is experiencing a notable surge in demand for automation solutions. Laboratories are increasingly seeking to enhance efficiency and reduce human error through automated processes. This trend is driven by the need for faster turnaround times and improved accuracy in test results. According to recent data, the automation segment within the Laboratory Information Systems Market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. As laboratories strive to optimize workflows, the integration of automated systems is becoming essential, thereby propelling the growth of the Laboratory Information Systems Market.

Increasing Regulatory Compliance Requirements

The Laboratory Information Systems Market is significantly influenced by the growing emphasis on regulatory compliance. Laboratories are mandated to adhere to stringent regulations concerning data management, patient privacy, and quality assurance. This has led to an increased adoption of Laboratory Information Systems Market that facilitate compliance with standards such as ISO and CLIA. The market is expected to witness a rise in demand for solutions that offer robust compliance features, as laboratories aim to mitigate risks associated with non-compliance. The Laboratory Information Systems Market is thus poised for growth, driven by the necessity for systems that ensure adherence to evolving regulatory frameworks.