Research Methodology on Healthcare IT Market

Introduction

The research report by MRFR examines the Healthcare IT market, with particular emphasis on the profitability prospects, market opportunities and future market size. The report provides an in-depth evaluation of the market drivers and challenges, and the competitive landscape, and estimates the market performance over the forecast period 2023 to 2030. The report assesses important industry trends, examines major market segments and provides an outlook for the Healthcare IT market during the review period.

Research Methodology

This comprehensive market research report is designed to provide comprehensive data on the Healthcare IT market. The research methodology is conducted based on market analysis and validation to provide detailed information about the healthcare IT industry over the forecast period 2023 to 2030.

Primary Research

Primary research is conducted to gain a detailed understanding of the market and the competitive landscape. The primary research methodology includes interviews, surveys, and direct contact with industry experts. Data is collected from primary and secondary sources, which include government agencies, organizations, and industry associations. The collected data is then validated through discussions with market participants.

Secondary Research

Secondary research involves extensive secondary research activities such as a comprehensive read-through of relevant publications, magazines and newsletters, etc.

Data Validation

The collected data is put through a rigorous process of analysis and validation. The analytical processes involve multiple levels of data validation and corroboration of the collected information. The team deployed a core multi-disciplinary approach to validate the data.

Market Segmentation

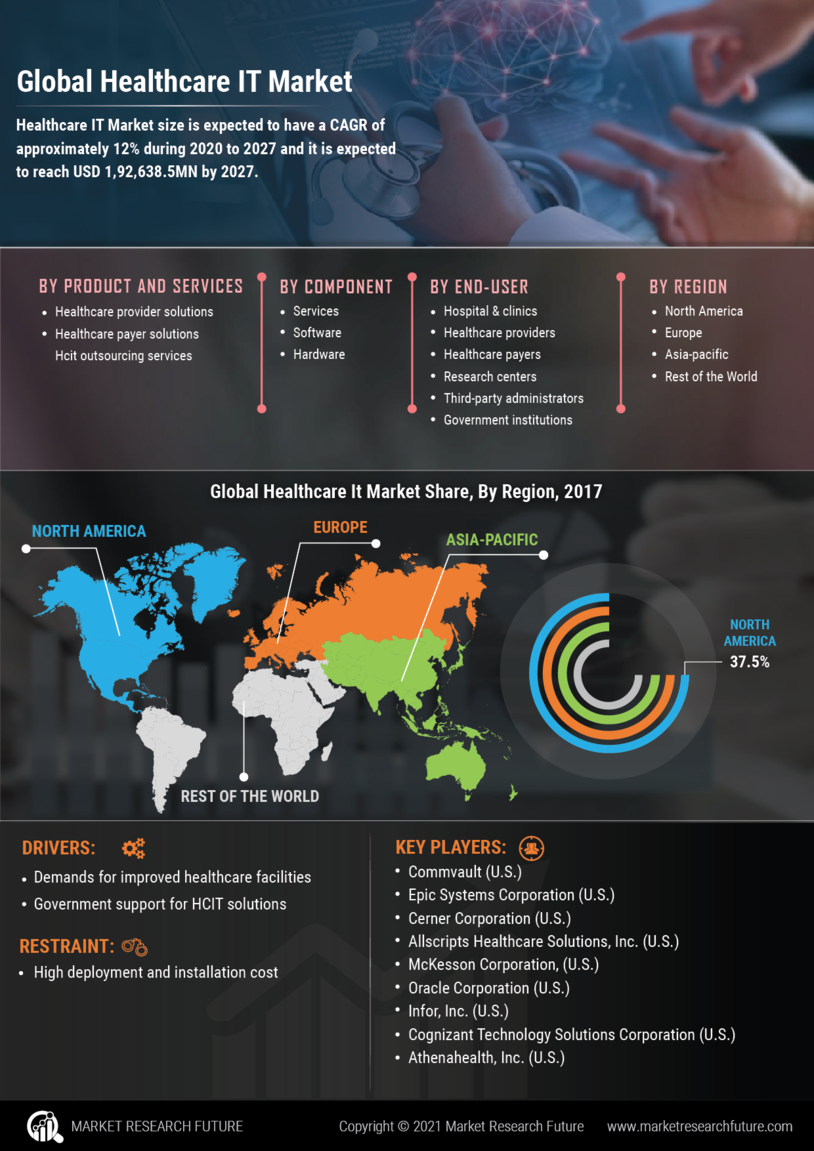

The market for Healthcare IT is segmented based on the following criteria:

By Technology:

- Cloud Computing

- Data Analytics and Management

- Telemedicine

- Robotic Surgery

- Electronic Health Records (EHR)

- Computer-Aided Diagnosis (CAD)

By Component:

- Software

- Services

- Hardware

By End-User:

- Hospitals and Clinics

- Diagnostic Centers

- Patients

- Other End-Users

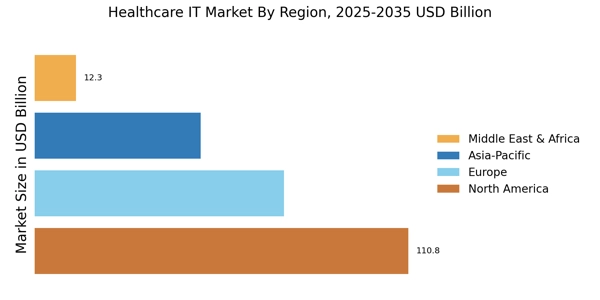

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis

The regional analysis has been conducted for North America, Europe, Asia-Pacific (APAC), Latin America and the Middle East and Africa (MEA).

Competitive Analysis

The competitive analysis provides a brief analysis of the vendor landscape, major players and their business objectives and strategies. This analysis helps to understand the competitive environment and the major players in the market. The major players included in the analysis are Philips Healthcare, Siemens Healthineers, McKesson Corporation, Cerner Corporation, Allscripts, Allscripts Healthcare Solutions, GE Healthcare, Epic Systems Corporation, and Athena Health.

Conclusion

This comprehensive market research report is carefully detailed for an in-depth assessment of the Healthcare IT market. The report provides a complete understanding of the market drivers and challenges as well as a detailed overview of the competitive landscape. Regional analysis and market segmentation are provided to gain insights into the market. The report also provides a comprehensive outlook and an analysis of the major key players in the Healthcare IT market.