Rising Focus on Quality Control

Quality control remains a pivotal aspect of laboratory operations, and the Japan laboratory information management systems market is responding to this need. Laboratories are increasingly implementing LIMS to ensure that their processes meet stringent quality standards. The ability to track samples, manage workflows, and maintain comprehensive records is essential for compliance with both domestic and international regulations. As Japanese laboratories strive to enhance their quality assurance protocols, the adoption of LIMS is expected to increase. This trend is likely to contribute to the overall growth of the market, as organizations seek to improve their quality control measures and maintain their competitive edge.

Supportive Government Initiatives

The Japanese government has been actively promoting the adoption of advanced technologies in various sectors, including the laboratory information management systems market. Initiatives aimed at enhancing research capabilities and fostering innovation are likely to create a conducive environment for LIMS adoption. Government funding and support for research institutions and laboratories can facilitate the integration of LIMS, thereby improving data management and operational efficiency. This supportive stance from the government may encourage more laboratories to invest in LIMS, contributing to the overall growth trajectory of the market in Japan.

Emphasis on Automation and Efficiency

In the Japan laboratory information management systems market, there is a pronounced emphasis on automation and operational efficiency. Laboratories are increasingly adopting LIMS to streamline workflows, reduce manual errors, and enhance productivity. Automation not only minimizes the time spent on routine tasks but also allows laboratory personnel to focus on more complex analyses. The integration of automated systems is expected to lead to a reduction in operational costs, which is particularly appealing in a competitive market. As a result, the demand for LIMS that offer robust automation features is likely to rise, further propelling the growth of the market in Japan.

Growing Demand for Data Management Solutions

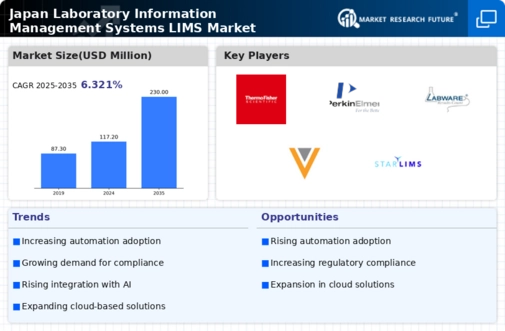

The Japan laboratory information management systems market is experiencing a notable surge in demand for efficient data management solutions. Laboratories are increasingly recognizing the necessity of managing vast amounts of data generated from various experiments and analyses. This trend is driven by the need for improved accuracy, traceability, and compliance with regulatory standards. According to recent statistics, the market for laboratory information management systems in Japan is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is indicative of the laboratories' shift towards adopting sophisticated data management tools that enhance operational efficiency and facilitate better decision-making processes.

Increasing Collaboration in Research and Development

Collaboration among research institutions, universities, and private laboratories is becoming increasingly prevalent in Japan. This trend is influencing the laboratory information management systems market, as collaborative projects often require robust data management solutions. LIMS play a crucial role in facilitating data sharing and ensuring that all stakeholders have access to accurate and timely information. As collaborative research efforts expand, the demand for LIMS that can support multi-user environments and integrate with various data sources is likely to grow. This shift may drive innovation and enhance the overall capabilities of laboratories in Japan.