North America : Market Leader in JIT Services

North America is poised to maintain its leadership in the Just-In-Time (JIT) Inventory Consulting Services market, holding a significant market share of $3.75B in 2025. The region's growth is driven by increasing demand for efficiency in supply chain management, coupled with advancements in technology and automation. Regulatory support for lean manufacturing practices further catalyzes this trend, making JIT methodologies more appealing to businesses seeking cost reduction and improved operational efficiency.

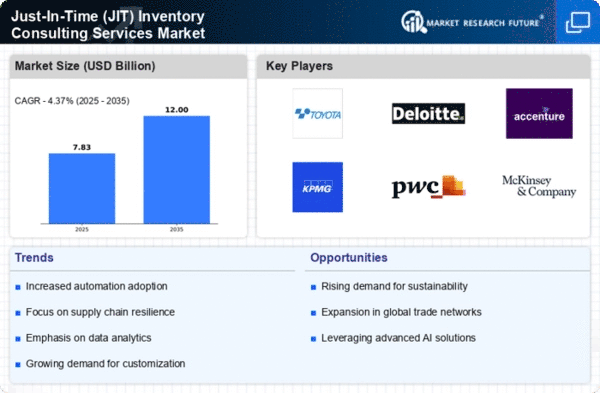

The competitive landscape in North America is robust, featuring key players such as Deloitte Consulting LLP, Accenture PLC, and McKinsey & Company. The U.S. stands out as the leading country, with a strong focus on innovation and technology integration in inventory management. Companies are increasingly adopting JIT strategies to enhance responsiveness to market changes, thereby solidifying their positions in the global market.

Europe : Emerging Market with Growth Potential

Europe's Just-In-Time (JIT) Inventory Consulting Services market is on a growth trajectory, with a market size of $2.25B projected for 2025. The region benefits from a strong emphasis on sustainability and efficiency, driven by regulatory frameworks that encourage lean practices. The European Union's initiatives to streamline supply chains and reduce waste are significant catalysts for the adoption of JIT methodologies across various industries.

Leading countries in this region include Germany, France, and the UK, where major consulting firms like KPMG International and PwC Advisory Services LLC are actively engaged. The competitive landscape is characterized by a mix of established players and emerging firms, all vying to capture market share in a rapidly evolving environment. The focus on digital transformation further enhances the appeal of JIT solutions in Europe.

Asia-Pacific : Rapid Growth in JIT Adoption

The Asia-Pacific region is witnessing a surge in the Just-In-Time (JIT) Inventory Consulting Services market, projected to reach $1.5B by 2025. This growth is fueled by increasing industrialization, urbanization, and a rising demand for efficient supply chain solutions. Governments in the region are implementing policies that support lean manufacturing and JIT practices, further driving market expansion and adoption among businesses seeking to optimize their operations.

Countries like China, Japan, and India are at the forefront of this growth, with significant investments in technology and infrastructure. Key players such as Toyota Industries Corporation and Capgemini SE are actively participating in this market, providing innovative solutions tailored to local needs. The competitive landscape is dynamic, with both The Just-In-Time (JIT) Inventory Consulting Services.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is gradually emerging in the Just-In-Time (JIT) Inventory Consulting Services market, with a projected size of $0.75B by 2025. The growth is primarily driven by increasing investments in infrastructure and a growing awareness of the benefits of JIT methodologies. However, challenges such as political instability and varying regulatory environments can hinder market development, making it essential for businesses to navigate these complexities effectively.

Leading countries in this region include South Africa and the UAE, where there is a growing interest in adopting JIT practices to enhance supply chain efficiency. The competitive landscape is still developing, with a mix of local and international players striving to establish their foothold. As the market matures, the focus on technology adoption and process optimization will be crucial for success in this region.