North America : Market Leader in Software Services

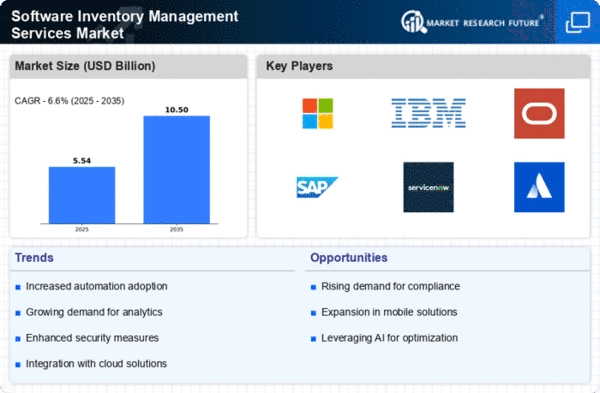

North America continues to lead the Software Inventory Management Services market, holding a significant share of 2.6B in 2024. The region's growth is driven by rapid technological advancements, increasing demand for cloud-based solutions, and stringent regulatory frameworks that promote efficient software management. Companies are increasingly adopting these services to optimize their software assets and reduce costs, further fueling market expansion. The competitive landscape in North America is robust, featuring key players such as Microsoft, IBM, and Oracle. These companies are investing heavily in innovation and partnerships to enhance their service offerings. The presence of established tech hubs in the US, along with a strong focus on cybersecurity and compliance, positions North America as a pivotal player in the global market.

Europe : Emerging Market with Growth Potential

Europe's Software Inventory Management Services market is valued at 1.5B, reflecting a growing trend towards digital transformation across various sectors. The region is witnessing increased demand for software management solutions driven by regulatory compliance requirements and the need for operational efficiency. Governments are promoting digital initiatives, which act as catalysts for market growth, ensuring that organizations can manage their software assets effectively. Leading countries in Europe, such as Germany and the UK, are at the forefront of this evolution, with significant investments from key players like SAP and IBM. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying for market share. The European market is expected to continue its upward trajectory as organizations increasingly recognize the value of effective software inventory management.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region, with a market size of 1.0B, is experiencing rapid growth in Software Inventory Management Services. This surge is fueled by the increasing adoption of digital technologies, a growing number of SMEs, and government initiatives aimed at enhancing IT infrastructure. The demand for efficient software management solutions is rising as businesses seek to optimize their operations and reduce costs, making this region a key player in the global market landscape. Countries like India and Australia are leading the charge, with significant contributions from local players such as Freshworks and Atlassian. The competitive environment is dynamic, with both established companies and new entrants striving to capture market share. As organizations in the region continue to embrace digital transformation, the demand for software inventory management services is expected to grow significantly.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa (MEA) region, with a market size of 0.1B, presents significant growth opportunities in Software Inventory Management Services. The market is gradually evolving, driven by increasing digitalization efforts and a growing awareness of the importance of software asset management. Governments in the region are implementing policies to support technology adoption, which is expected to catalyze market growth in the coming years. Countries like South Africa and the UAE are leading the way in adopting software management solutions, with a mix of local and international players entering the market. The competitive landscape is still developing, but the presence of key players is beginning to shape the market dynamics. As organizations in the MEA region recognize the value of effective software inventory management, the market is poised for substantial growth.