North America : Market Leader in VMI Services

North America continues to lead the Vendor Managed Inventory (VMI) Consulting Services market, holding a significant share of 1.75B in 2024. The region's growth is driven by increasing demand for supply chain efficiency and technological advancements. Regulatory support for digital transformation and logistics optimization further catalyzes market expansion. Companies are increasingly adopting VMI solutions to enhance inventory management and reduce operational costs.

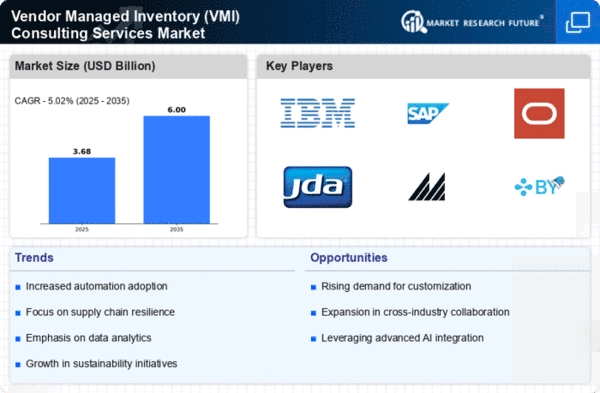

The competitive landscape in North America is robust, featuring key players such as IBM, Oracle, and JDA Software. The U.S. stands out as the primary market, driven by its advanced technological infrastructure and a strong focus on innovation. The presence of major consulting firms and technology providers fosters a dynamic environment for VMI services, ensuring continuous growth and adaptation to market needs.

Europe : Emerging Market with Growth Potential

Europe's Vendor Managed Inventory (VMI) Consulting Services market is valued at 1.0B, reflecting a growing trend towards integrated supply chain solutions. The region is witnessing increased demand for VMI services due to regulatory initiatives aimed at enhancing supply chain transparency and efficiency. The European Union's focus on sustainability and digitalization is also driving the adoption of VMI practices across various sectors.

Leading countries in Europe include Germany, France, and the UK, where major players like SAP and Oracle are actively expanding their services. The competitive landscape is characterized by a mix of established firms and emerging startups, fostering innovation. The region's commitment to improving logistics and inventory management positions it well for future growth in the VMI consulting market.

Asia-Pacific : Rapidly Growing VMI Market

The Asia-Pacific region, with a market size of 0.6B, is rapidly emerging in the Vendor Managed Inventory (VMI) Consulting Services sector. The growth is fueled by increasing industrialization, urbanization, and the need for efficient supply chain management. Governments are promoting digital initiatives to enhance logistics and inventory practices, which is expected to drive further adoption of VMI solutions in the coming years.

Countries like China, India, and Japan are leading the charge, with significant investments in technology and infrastructure. The competitive landscape features both global players and local firms, creating a diverse market environment. As businesses seek to optimize their operations, the demand for VMI consulting services is anticipated to grow significantly, positioning the region as a key player in the global market.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region, with a market size of 0.15B, is in the early stages of adopting Vendor Managed Inventory (VMI) Consulting Services. The growth is hindered by infrastructural challenges and varying levels of technological adoption across countries. However, there is a growing recognition of the need for efficient supply chain solutions, driven by increasing trade and economic diversification efforts in the region.

Countries like South Africa and the UAE are beginning to embrace VMI practices, supported by government initiatives aimed at improving logistics and supply chain efficiency. The competitive landscape is still developing, with a mix of local and international players entering the market. As awareness of VMI benefits grows, the region is expected to see gradual improvements in service adoption and market growth.