Growth of E-commerce

The Retail Inventory Management Software Market is significantly influenced by the rapid growth of e-commerce. As online shopping continues to expand, retailers are compelled to adopt sophisticated inventory management solutions to handle increased order volumes and diverse product offerings. Data suggests that e-commerce sales have seen a consistent annual growth rate of around 15%, necessitating robust inventory management systems. These systems enable retailers to synchronize their online and offline inventory, ensuring that stock levels are accurately reflected across all sales channels. Consequently, the integration of advanced inventory management software is becoming a strategic priority for retailers.

Emphasis on Cost Reduction

Cost reduction remains a pivotal driver in the Retail Inventory Management Software Market. Retailers are under constant pressure to minimize operational costs while maximizing profitability. Effective inventory management software can lead to significant savings by reducing excess stock, minimizing stockouts, and optimizing order fulfillment processes. Recent studies indicate that retailers utilizing advanced inventory management solutions can achieve cost reductions of up to 20%. This financial incentive encourages retailers to invest in software that streamlines their inventory processes, ultimately enhancing their competitive edge in a crowded marketplace.

Technological Advancements

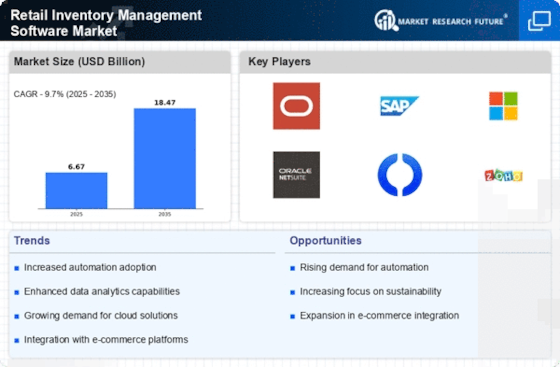

Technological advancements are reshaping the Retail Inventory Management Software Market. Innovations such as machine learning, artificial intelligence, and the Internet of Things are being integrated into inventory management solutions, enhancing their capabilities. These technologies enable predictive analytics, which assists retailers in forecasting demand more accurately and managing stock levels efficiently. The adoption of such technologies is expected to grow, with projections indicating that the market for AI-driven inventory management solutions could reach several billion dollars by 2026. This trend underscores the importance of staying abreast of technological developments to remain competitive.

Increased Demand for Real-Time Data

The Retail Inventory Management Software Market is experiencing a surge in demand for real-time data analytics. Retailers are increasingly recognizing the necessity of having immediate access to inventory levels, sales trends, and customer preferences. This demand is driven by the need to enhance operational efficiency and improve customer satisfaction. According to recent data, approximately 70% of retailers indicate that real-time inventory visibility is crucial for their business operations. As a result, software solutions that provide real-time insights are becoming essential tools for retailers aiming to optimize their supply chain and inventory management processes.

Regulatory Compliance and Standards

Regulatory compliance is increasingly becoming a critical driver in the Retail Inventory Management Software Market. Retailers must adhere to various regulations concerning inventory tracking, product safety, and data protection. Compliance with these regulations necessitates the implementation of robust inventory management systems that can accurately track and report inventory data. As regulatory scrutiny intensifies, retailers are likely to invest in software solutions that not only streamline their inventory processes but also ensure compliance with industry standards. This focus on regulatory adherence is expected to drive growth in the inventory management software sector.