Rising Health Consciousness

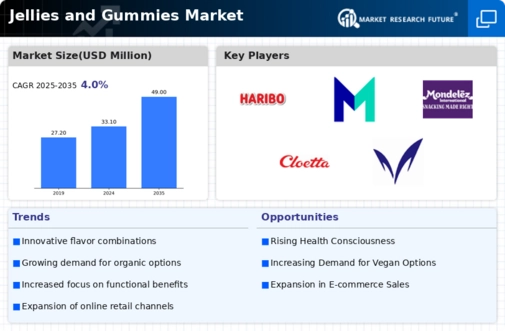

The increasing awareness of health and wellness among consumers appears to be a significant driver for the Global Jellies and Gummies Industry. As individuals seek healthier alternatives to traditional sweets, manufacturers are responding by developing products that incorporate natural ingredients, reduced sugar content, and added vitamins. This trend is particularly evident in the growing demand for functional gummies that offer health benefits, such as immune support and stress relief. The market is projected to reach 33.1 USD Billion in 2024, indicating a robust consumer shift towards healthier confectionery options.

Innovative Product Offerings

Innovation within the Global Jellies and Gummies Industry plays a crucial role in attracting diverse consumer segments. Companies are increasingly experimenting with unique flavors, textures, and shapes to differentiate their products. For instance, the introduction of plant-based and organic gummies caters to the rising vegan and vegetarian populations. Additionally, limited-edition flavors and collaborations with popular brands enhance consumer interest. This continuous innovation is expected to contribute to the market's growth, with projections indicating a rise to 49.0 USD Billion by 2035, showcasing the industry's adaptability to changing consumer preferences.

Expansion of Distribution Channels

The expansion of distribution channels is a notable driver for the Global Jellies and Gummies Industry. Retailers are increasingly adopting omnichannel strategies, combining online and offline sales to enhance consumer accessibility. E-commerce platforms have gained traction, allowing consumers to purchase jellies and gummies conveniently from home. Furthermore, partnerships with supermarkets and convenience stores ensure that these products are readily available to a broader audience. This strategic distribution approach is likely to facilitate market growth, as it aligns with the projected CAGR of 3.63% for the period from 2025 to 2035.

Increased Marketing and Branding Efforts

Increased marketing and branding efforts are pivotal in shaping the Global Jellies and Gummies Industry. Companies are investing in targeted advertising campaigns to raise awareness and promote their products effectively. Social media platforms serve as vital channels for engaging with consumers, particularly younger demographics. Influencer partnerships and creative content strategies are employed to enhance brand visibility and consumer loyalty. This heightened focus on marketing is likely to contribute to the overall market expansion, as brands strive to capture a larger share of the growing consumer base.

Growing Demand for Vegan and Organic Products

The rising demand for vegan and organic products significantly influences the Global Jellies and Gummies Industry. As consumers become more environmentally conscious and health-focused, they are increasingly seeking out plant-based alternatives. This trend has prompted manufacturers to develop jellies and gummies that are free from animal-derived ingredients and artificial additives. The market's response to this demand is evident in the increasing variety of vegan-friendly options available. This shift not only caters to ethical consumerism but also aligns with the broader trend of sustainability, further driving market growth.