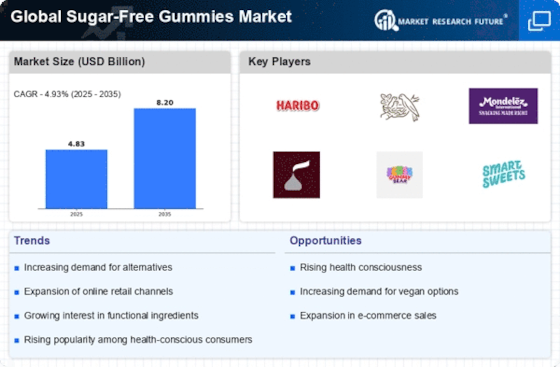

The Global Sugar-Free Gummies Market is currently characterized by a dynamic competitive landscape, driven by increasing consumer demand for healthier alternatives to traditional confectionery. Key players are actively engaging in innovative product development, strategic partnerships, and regional expansions to capture market share. Companies such as Haribo (DE), Nestle (CH), and SmartSweets (CA) are at the forefront, leveraging their brand equity and distribution networks to enhance their market presence. Haribo, for instance, has focused on expanding its sugar-free product line, while Nestle has been investing in digital transformation to better connect with health-conscious consumers. These strategies collectively contribute to a competitive environment that is increasingly focused on health and wellness, as well as consumer engagement.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several players vying for dominance. However, the collective influence of major companies like Mondelez International (US) and The Hershey Company (US) is notable, as they continue to innovate and adapt to changing consumer preferences. This competitive structure allows for a diverse range of products, catering to various dietary needs and preferences, which is essential in a market that is rapidly evolving.

In August Mondelez International (US) announced the launch of a new line of sugar-free gummies aimed at children, incorporating natural flavors and colors. This strategic move is significant as it not only targets a growing demographic concerned with health but also aligns with the company's broader commitment to sustainability and responsible sourcing. By focusing on children, Mondelez is likely to capture a segment of the market that is increasingly influenced by parental purchasing decisions, thereby enhancing its competitive positioning.

In September The Hershey Company (US) unveiled a partnership with a leading health and wellness influencer to promote its new sugar-free gummy range. This collaboration is indicative of a broader trend where companies are leveraging social media and influencer marketing to reach health-conscious consumers. The strategic importance of this partnership lies in its potential to enhance brand visibility and credibility, particularly among younger demographics who are more likely to engage with influencer content.

In July SmartSweets (CA) expanded its distribution channels by entering into a partnership with a major online retailer, significantly increasing its market reach. This move is crucial as it allows SmartSweets to tap into the growing e-commerce segment, which has become increasingly vital for consumer goods. By enhancing accessibility, SmartSweets is likely to strengthen its competitive edge in the sugar-free gummies market, appealing to consumers who prioritize convenience and health.

As of October current competitive trends in the Global Sugar-Free Gummies Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence in product development and marketing strategies. Strategic alliances are becoming increasingly important, as companies seek to enhance their innovation capabilities and market reach. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize these areas will likely emerge as leaders in the market.