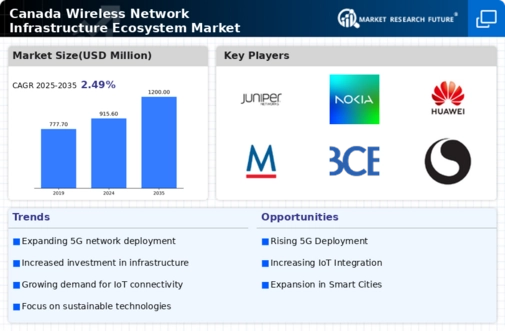

Rising Demand for Mobile Data

The increasing reliance on mobile devices and applications drives the demand for robust wireless network infrastructure in Canada. As of January 2026, mobile data consumption continues to rise, with Canadians reportedly using an average of 8.5 GB of data per month. This trend is indicative of a broader shift towards mobile-first strategies among consumers and businesses alike. The Canada wireless network infrastructure ecosystem market must adapt to this growing demand by expanding capacity and improving network reliability. Service providers are likely to invest in advanced technologies, such as 5G, to meet consumer expectations for faster and more reliable connections. This surge in mobile data usage not only necessitates infrastructure upgrades but also presents opportunities for innovation in service delivery and customer engagement.

Increased Focus on Cybersecurity

As the Canada wireless network infrastructure ecosystem market expands, the importance of cybersecurity becomes increasingly pronounced. With the rise in cyber threats, service providers and infrastructure developers are prioritizing the implementation of robust security measures. The Canadian government has recognized this need and is actively promoting cybersecurity initiatives to protect critical infrastructure. For example, the National Cyber Security Strategy aims to enhance the resilience of Canada's digital infrastructure, which includes wireless networks. This focus on cybersecurity not only safeguards consumer data but also fosters trust in wireless services. As businesses and consumers become more aware of cybersecurity risks, the demand for secure wireless infrastructure is likely to grow, prompting further investment in protective technologies and practices.

Government Initiatives and Funding

The Canada wireless network infrastructure ecosystem market benefits from various government initiatives aimed at enhancing connectivity across the nation. The Canadian government has allocated substantial funding to improve broadband access, particularly in underserved areas. For instance, the Universal Broadband Fund, with a budget of CAD 1.75 billion, aims to provide high-speed internet access to rural and remote communities. This funding is crucial for the development of wireless infrastructure, as it encourages private sector investment and innovation. Furthermore, the government's commitment to achieving 100% connectivity by 2030 indicates a strong policy direction that supports the growth of the wireless network infrastructure ecosystem. Such initiatives not only enhance service availability but also stimulate economic growth by enabling businesses and residents to access digital services.

Growing Adoption of Smart Technologies

The growing adoption of smart technologies across various sectors is a key driver for the Canada wireless network infrastructure ecosystem market. As of January 2026, sectors such as healthcare, transportation, and agriculture are increasingly integrating smart solutions that rely on robust wireless connectivity. For instance, smart cities initiatives are being implemented in urban areas, utilizing wireless networks to enhance public services and improve quality of life. This trend necessitates the development of advanced wireless infrastructure capable of supporting a multitude of connected devices and applications. The demand for smart technologies not only drives investment in network infrastructure but also encourages collaboration between public and private sectors to create innovative solutions. As the adoption of smart technologies continues to rise, the wireless network infrastructure ecosystem will likely evolve to meet these new challenges and opportunities.

Technological Advancements in Network Infrastructure

Technological advancements play a pivotal role in shaping the Canada wireless network infrastructure ecosystem market. Innovations such as 5G technology, edge computing, and the Internet of Things (IoT) are transforming how networks are built and operated. The deployment of 5G networks, for instance, is expected to enhance data speeds and reduce latency, thereby enabling new applications and services. As of January 2026, the Canadian government has set ambitious targets for 5G rollout, aiming for widespread availability by 2027. This technological evolution not only improves user experience but also encourages investment in infrastructure development. Companies that leverage these advancements are likely to gain a competitive edge, as they can offer enhanced services that meet the evolving needs of consumers and businesses in the wireless network infrastructure ecosystem.