Growing Cyber Threat Landscape

The Japan cybersecurity market is currently experiencing a surge in cyber threats, which appears to be a primary driver for growth. With the increasing sophistication of cyberattacks, organizations are compelled to invest in advanced security measures. Reports indicate that Japan has seen a rise in ransomware attacks, targeting both public and private sectors. This evolving threat landscape necessitates a robust cybersecurity framework, prompting businesses to allocate more resources towards cybersecurity solutions. As a result, the demand for cybersecurity services and products is likely to escalate, fostering innovation and competition within the Japan cybersecurity market.

Government Initiatives and Support

The Japanese government has been proactive in enhancing the cybersecurity posture of the nation, which significantly influences the Japan cybersecurity market. Initiatives such as the Cybersecurity Strategy of 2021 aim to bolster national security and protect critical infrastructure. The government has also established the National Center of Incident Readiness and Strategy for Cybersecurity (NISC) to coordinate responses to cyber incidents. Such governmental support not only encourages private sector investment but also fosters collaboration between public and private entities. Consequently, this creates a conducive environment for the growth of cybersecurity solutions and services in the Japan cybersecurity market.

Emergence of Cybersecurity Startups

The Japan cybersecurity market is witnessing a notable emergence of startups focused on innovative cybersecurity solutions. These startups are leveraging cutting-edge technologies to address specific cybersecurity challenges faced by businesses. The rise of these new entrants is indicative of a vibrant ecosystem that fosters creativity and technological advancement. Many of these startups are developing solutions that cater to niche markets, such as IoT security and threat intelligence. This influx of fresh ideas and approaches is likely to enhance the overall cybersecurity landscape in Japan, driving growth and diversification within the Japan cybersecurity market.

Digital Transformation and Remote Work

The ongoing digital transformation across various sectors in Japan is a crucial driver for the Japan cybersecurity market. As organizations increasingly adopt digital technologies and remote work practices, the attack surface for cyber threats expands. This shift necessitates enhanced cybersecurity measures to protect sensitive data and maintain operational integrity. According to recent statistics, over 70% of Japanese companies have adopted remote work policies, which has led to a heightened focus on securing remote access and cloud-based services. Therefore, the demand for cybersecurity solutions tailored to support digital transformation is likely to grow, further propelling the Japan cybersecurity market.

Increased Investment in Cybersecurity Solutions

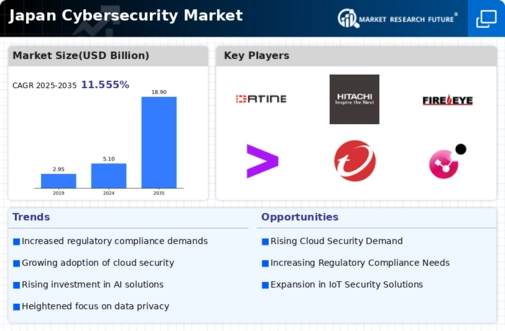

Investment in cybersecurity solutions is on the rise within the Japan cybersecurity market, driven by the recognition of cybersecurity as a critical business priority. Organizations are increasingly allocating budgets to enhance their cybersecurity infrastructure, with spending projected to reach over 1 trillion yen by 2026. This trend reflects a growing awareness of the potential financial and reputational damage caused by cyber incidents. As businesses seek to mitigate risks, the demand for advanced cybersecurity technologies, such as artificial intelligence and machine learning, is expected to increase. This influx of investment is likely to stimulate innovation and competition within the Japan cybersecurity market.