Growing Awareness of Eye Health

There is a noticeable increase in public awareness regarding eye health in Italy, which is positively influencing the ophthalmic drugs devices market. Campaigns aimed at educating the population about the importance of regular eye examinations and early detection of eye diseases are gaining traction. This heightened awareness is leading to more individuals seeking preventive care and treatment options, thereby driving demand for ophthalmic products. According to surveys, nearly 60% of Italians now recognize the significance of eye health, which is a substantial increase compared to previous years. This trend suggests that healthcare providers may need to adapt their strategies to meet the growing expectations of informed patients. Consequently, the Italy ophthalmic drugs devices market is likely to benefit from this shift in consumer behavior, as more people prioritize their eye health.

Regulatory Support for Innovation

The regulatory environment in Italy is becoming increasingly supportive of innovation within the ophthalmic drugs devices market. The Italian Medicines Agency (AIFA) has implemented streamlined approval processes for new ophthalmic products, which encourages manufacturers to invest in research and development. This regulatory framework is designed to facilitate quicker access to advanced therapies and devices for patients. Moreover, the European Union's Medical Device Regulation (MDR) is also influencing the market by ensuring that new products meet high safety and efficacy standards. As a result, companies are more inclined to introduce novel solutions, which could potentially enhance patient care and treatment outcomes. The proactive stance of regulatory bodies in Italy is likely to foster a more dynamic market environment, ultimately benefiting both healthcare providers and patients.

Rising Incidence of Eye Disorders

The prevalence of eye disorders in Italy is on the rise, which is significantly impacting the ophthalmic drugs devices market. Conditions such as cataracts, glaucoma, and age-related macular degeneration are becoming increasingly common, particularly among the aging population. Recent statistics indicate that approximately 25% of the Italian population over the age of 65 suffers from some form of visual impairment. This growing demographic is likely to drive demand for both pharmaceutical and device-based interventions. As a result, healthcare providers are focusing on enhancing their offerings in the ophthalmic sector, leading to an expansion of the market. The increasing incidence of eye disorders not only necessitates innovative treatment options but also emphasizes the importance of preventive care, thereby shaping the future landscape of the Italy ophthalmic drugs devices market.

Investment in Research and Development

Investment in research and development (R&D) within the Italy ophthalmic drugs devices market is witnessing a significant uptick. Pharmaceutical companies and device manufacturers are increasingly allocating resources to develop innovative solutions that address unmet medical needs in ophthalmology. This trend is partly driven by the competitive landscape, where companies strive to differentiate their offerings through advanced technologies and novel therapies. Recent data indicates that R&D spending in the ophthalmic sector in Italy has increased by approximately 10% over the past year. This investment is expected to yield new products that enhance treatment efficacy and patient outcomes. Furthermore, collaborations between academic institutions and industry players are likely to foster innovation, creating a robust pipeline of ophthalmic products. As a result, the Italy ophthalmic drugs devices market is poised for growth, driven by a commitment to advancing eye care.

Technological Advancements in Ophthalmic Devices

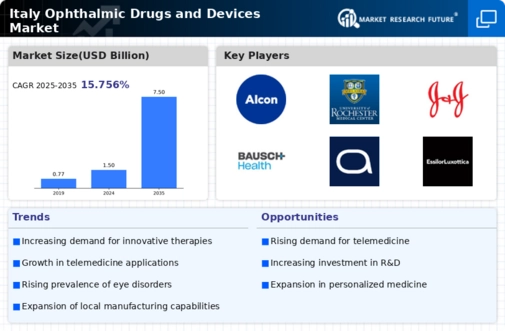

The Italy ophthalmic drugs devices market is experiencing a notable transformation due to rapid technological advancements. Innovations such as minimally invasive surgical techniques and advanced imaging systems are enhancing diagnostic accuracy and treatment efficacy. For instance, the introduction of optical coherence tomography (OCT) has revolutionized the way eye diseases are diagnosed and monitored. Furthermore, the integration of artificial intelligence in ophthalmic devices is streamlining workflows and improving patient outcomes. According to recent data, the market for ophthalmic devices in Italy is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by these technological innovations. This trend suggests that the industry is likely to witness increased investment in research and development, fostering a competitive landscape that prioritizes cutting-edge solutions.