Aging Population

The aging population in Italy is a critical driver for the medical device market. As the demographic shifts towards an older age group, the demand for medical devices that cater to chronic diseases and age-related health issues is likely to increase. In 2025, approximately 23% of the Italian population is projected to be over 65 years old, which suggests a growing need for devices such as orthopedic implants, cardiovascular devices, and home healthcare equipment. This trend indicates that the Italy medical device market must adapt to meet the specific needs of this demographic, potentially leading to innovations in product design and functionality.

Regulatory Environment

The regulatory environment in Italy significantly influences the medical device market. The Italian Medicines Agency (AIFA) and the Ministry of Health oversee the approval and monitoring of medical devices, ensuring compliance with European Union regulations. This regulatory framework is designed to enhance patient safety and product efficacy. As the market evolves, the introduction of new regulations, such as the Medical Device Regulation (MDR), necessitates that manufacturers adapt their processes to meet stringent requirements. This dynamic regulatory landscape may present challenges but also opportunities for companies to innovate and differentiate their products in the competitive Italy medical device market.

Technological Advancements

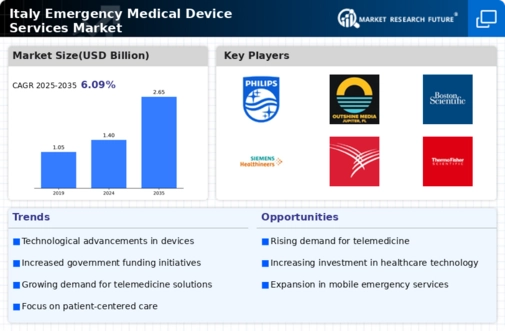

Technological advancements play a pivotal role in shaping the Italy medical device market. Innovations in areas such as minimally invasive surgery, telemedicine, and wearable health monitoring devices are transforming patient care. For instance, the integration of artificial intelligence and machine learning in diagnostic tools is enhancing accuracy and efficiency. The Italian government has been supportive of research and development initiatives, allocating funds to promote innovation in healthcare technologies. This environment fosters a competitive landscape where companies are encouraged to develop cutting-edge medical devices that improve patient outcomes and streamline healthcare processes.

Rising Healthcare Expenditure

Rising healthcare expenditure in Italy is a substantial driver for the medical device market. The Italian government has been increasing its healthcare budget to improve services and access to medical technologies. In 2025, healthcare spending is expected to reach approximately 9% of the GDP, indicating a commitment to enhancing healthcare infrastructure. This increase in funding is likely to facilitate the procurement of advanced medical devices, thereby stimulating market growth. Furthermore, as hospitals and healthcare facilities invest in modern equipment, the demand for innovative medical devices will continue to rise, creating a favorable environment for industry players.

Focus on Preventive Healthcare

The growing focus on preventive healthcare is reshaping the Italy medical device market. There is an increasing awareness among the population regarding the importance of early detection and prevention of diseases. This trend is driving demand for diagnostic devices, screening tools, and health monitoring systems. The Italian government has initiated various public health campaigns aimed at promoting preventive measures, which may lead to higher adoption rates of medical devices designed for early intervention. As a result, companies in the medical device sector are likely to invest in developing products that align with this preventive healthcare paradigm, thereby expanding their market presence.