Expansion of Digital Health Initiatives

The expansion of digital health initiatives is significantly influencing the medical device-connectivity market in Italy. The government and private sector are increasingly investing in digital health programs aimed at improving healthcare accessibility and efficiency. These initiatives often involve the integration of connected medical devices that facilitate telemedicine, remote monitoring, and data sharing among healthcare providers. Recent statistics suggest that the digital health market in Italy is projected to grow by over 20% annually, reflecting a strong commitment to enhancing healthcare delivery through technology. As these initiatives gain traction, the demand for medical devices that can seamlessly connect to digital health platforms is expected to rise. This trend not only supports better patient outcomes but also positions the medical device-connectivity market for robust growth as it aligns with the broader goals of digital transformation in healthcare.

Rising Demand for Remote Patient Monitoring

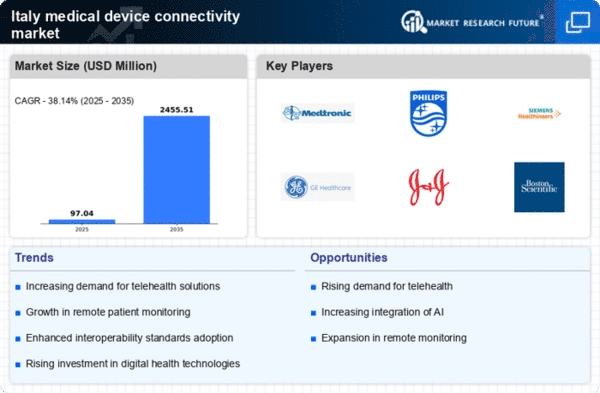

The medical device-connectivity market in Italy is experiencing a notable surge in demand for remote patient monitoring solutions. This trend is driven by an increasing emphasis on chronic disease management and the need for continuous health monitoring. According to recent data, the market for remote monitoring devices is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader shift towards proactive healthcare, where patients can be monitored in real-time, reducing hospital visits and enhancing patient outcomes. The integration of advanced connectivity features in medical devices facilitates seamless data transmission, thereby improving the efficiency of healthcare delivery. As healthcare providers in Italy adopt these technologies, the medical device-connectivity market is likely to expand significantly, catering to the evolving needs of both patients and healthcare professionals.

Technological Advancements in Medical Devices

Technological innovation plays a crucial role in shaping the medical device-connectivity market in Italy. The introduction of sophisticated technologies such as artificial intelligence (AI) and machine learning (ML) is enhancing the functionality of medical devices, enabling them to connect and communicate more effectively. These advancements allow for improved data analytics, which can lead to better clinical decision-making. For instance, AI-driven algorithms can analyze patient data in real-time, providing healthcare professionals with actionable insights. The Italian market is witnessing an influx of smart medical devices that not only connect to healthcare systems but also offer predictive analytics capabilities. This trend is expected to drive market growth, as healthcare providers increasingly seek to leverage technology to improve patient care and operational efficiency. The medical device-connectivity market is thus positioned for substantial growth as these technologies become more prevalent.

Growing Emphasis on Data Security and Compliance

Data security and compliance are becoming increasingly critical in the medical device-connectivity market in Italy. With the rise of connected medical devices, concerns regarding patient data privacy and security have intensified. Regulatory bodies are imposing stringent guidelines to ensure that medical devices comply with data protection laws, such as the General Data Protection Regulation (GDPR). This regulatory environment is pushing manufacturers to prioritize security features in their devices, which may involve additional costs but ultimately enhances trust among healthcare providers and patients. As a result, the medical device-connectivity market is likely to see a shift towards devices that not only offer connectivity but also robust security measures. This focus on compliance and security is expected to drive innovation, as companies strive to develop solutions that meet regulatory standards while providing seamless connectivity.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a significant driver of the medical device-connectivity market in Italy. The Italian government has been allocating substantial funds to enhance healthcare facilities and integrate advanced technologies. Recent reports indicate that healthcare spending in Italy is expected to reach €200 billion by 2026, with a considerable portion directed towards upgrading medical devices and connectivity solutions. This investment is aimed at improving healthcare delivery and ensuring that medical facilities are equipped with the latest technologies. As hospitals and clinics modernize their infrastructure, the demand for connected medical devices is likely to rise, facilitating better patient management and data sharing. Consequently, the medical device-connectivity market is poised to benefit from this influx of capital, which is essential for fostering innovation and improving healthcare outcomes across the country.