Regulatory Framework Enhancements

The regulatory environment in Italy is evolving to support the growth of the embolic protection-devices market. Recent reforms aimed at streamlining the approval process for medical devices are likely to facilitate quicker market entry for innovative products. The Italian Medicines Agency (AIFA) has implemented measures to ensure that new devices meet safety and efficacy standards while expediting their availability to healthcare providers. This regulatory support is crucial for manufacturers looking to introduce advanced embolic protection solutions. As a result, the market is expected to benefit from an influx of new products, potentially increasing competition and driving down costs for healthcare providers and patients alike.

Investment in Healthcare Infrastructure

Italy's commitment to improving its healthcare infrastructure significantly influences the embolic protection-devices market. The government has allocated substantial funding to modernize hospitals and medical facilities, which includes the procurement of advanced medical technologies. In 2025, healthcare expenditure is projected to reach approximately €200 billion, with a notable portion directed towards cardiovascular care. This investment not only enhances the availability of embolic protection devices but also encourages research and development in this field. As hospitals upgrade their equipment and adopt new technologies, the demand for effective embolic protection solutions is likely to increase, thereby driving market growth.

Technological Innovations in Device Design

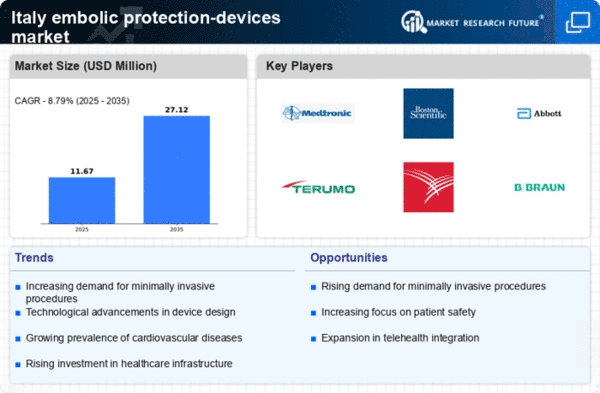

The embolic protection-devices market is experiencing a surge in innovation, driven by advancements in device design and materials. Italian manufacturers are at the forefront of developing next-generation embolic protection devices that offer improved efficacy and safety profiles. Innovations such as bioresorbable materials and enhanced delivery systems are making these devices more effective in preventing embolic events during surgical procedures. The market is projected to grow as these technological advancements gain traction with healthcare providers.. In 2025, it is anticipated that the introduction of new products could account for a 15% increase in market share, reflecting the importance of innovation in driving the embolic protection-devices market.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in Italy is a primary driver for the embolic protection-devices market. According to recent health statistics, cardiovascular diseases account for approximately 35% of all deaths in the country. This alarming trend necessitates advanced medical interventions, including embolic protection devices, to mitigate risks during procedures such as percutaneous coronary interventions. The demand for these devices is expected to rise as healthcare providers seek to enhance patient outcomes and reduce complications associated with cardiovascular surgeries. Furthermore, the Italian healthcare system is increasingly prioritizing innovative solutions to address this public health challenge, thereby fostering growth in the embolic protection-devices market.

Growing Awareness of Minimally Invasive Procedures

There is a notable shift towards minimally invasive surgical techniques in Italy, which is positively impacting the embolic protection-devices market. Patients and healthcare professionals are increasingly aware of the benefits associated with these procedures, such as reduced recovery times and lower complication rates. As a result, the demand for embolic protection devices, which are essential for ensuring safety during such interventions, is on the rise. Market analysts estimate that the adoption of minimally invasive techniques could lead to a growth rate of approximately 8% in the embolic protection-devices market over the next few years. This trend reflects a broader movement towards patient-centered care in the Italian healthcare landscape.