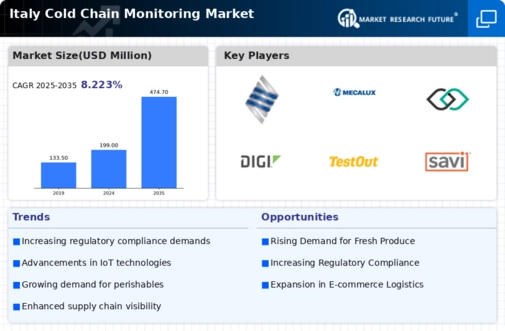

Rising Demand for Perishable Goods

The increasing consumption of perishable goods in Italy is a primary driver for the cold chain-monitoring market. As consumers become more health-conscious, the demand for fresh produce, dairy products, and meat has surged. This trend necessitates robust cold chain solutions to ensure product quality and safety. According to recent data, the Italian food and beverage sector is projected to grow by approximately 4.5% annually, further amplifying the need for effective cold chain monitoring. The cold chain-monitoring market is positioned to benefit from this rising demand. Businesses seek to maintain optimal temperature conditions throughout the supply chain to prevent spoilage and waste.

Expansion of the Pharmaceutical Sector

The growth of the pharmaceutical sector in Italy is a crucial factor propelling the cold chain-monitoring market. With an increasing number of temperature-sensitive medications and vaccines being developed, the need for stringent cold chain solutions has become paramount. The Italian pharmaceutical market is projected to reach €35 billion by 2026, with a significant portion of this growth attributed to biologics and specialty drugs that require precise temperature control. Consequently, The cold chain-monitoring market is expected to expand. Pharmaceutical companies are investing in advanced monitoring systems to ensure product integrity and compliance with health regulations.

Increased Focus on Food Safety Standards

The heightened emphasis on food safety standards in Italy is a significant driver for the cold chain-monitoring market. Regulatory bodies are enforcing stricter guidelines to ensure that food products are stored and transported under appropriate temperature conditions. This regulatory landscape compels businesses to invest in reliable cold chain solutions to avoid penalties and maintain consumer trust. Companies are likely to drive substantial growth in the cold chain-monitoring market as they strive to comply with these regulations. Recent statistics indicate that non-compliance can lead to losses exceeding €1 million for food businesses, underscoring the financial implications of inadequate cold chain management.

Technological Integration in Supply Chains

The integration of advanced technologies into supply chains is significantly influencing the cold chain-monitoring market. In Italy, companies are increasingly adopting IoT devices, blockchain technology, and AI-driven analytics to enhance visibility and control over temperature-sensitive products. This technological shift allows for real-time monitoring and data collection, which is crucial for compliance with food safety regulations. The cold chain-monitoring market is expected to expand. Businesses recognize the value of these technologies in reducing operational costs and improving efficiency. It is estimated that the adoption of such technologies could lead to a 20% reduction in spoilage rates, thereby driving market growth.

Rising E-commerce and Home Delivery Services

The surge in e-commerce and home delivery services in Italy is driving demand for the cold chain-monitoring market. As consumers increasingly prefer online shopping for groceries and other perishable items, retailers are compelled to implement effective cold chain solutions to ensure product freshness during transit. The anticipated growth of the e-commerce food market in Italy by 15% annually creates a substantial opportunity for cold chain monitoring technologies. Businesses are likely to invest in sophisticated tracking systems to maintain optimal conditions, thereby enhancing customer satisfaction and reducing returns due to spoilage.