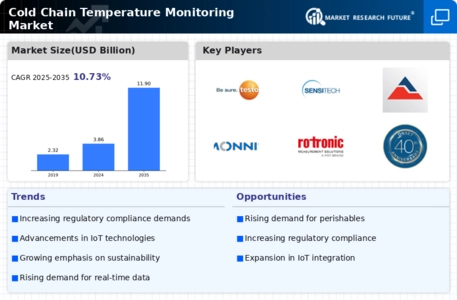

Increasing Regulatory Pressure

Regulatory bodies are imposing stricter guidelines regarding the transportation and storage of temperature-sensitive products, significantly impacting the Cold Chain Temperature Monitoring Market. Compliance with regulations such as the Food Safety Modernization Act (FSMA) and Good Distribution Practice (GDP) is becoming mandatory for companies involved in the cold chain. These regulations require businesses to implement robust temperature monitoring systems to ensure product safety and quality. The heightened focus on compliance is expected to drive market growth, as companies invest in advanced monitoring technologies to meet these regulatory demands. The Cold Chain Temperature Monitoring Market is likely to expand as organizations prioritize adherence to these evolving standards.

Rising Demand for Perishable Goods

The increasing consumption of perishable goods, such as fresh produce, dairy products, and pharmaceuticals, drives the Cold Chain Temperature Monitoring Market. As consumers become more health-conscious, the demand for fresh and organic products rises. This trend necessitates stringent temperature control during transportation and storage to maintain product quality and safety. According to industry estimates, the perishable goods market is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. Consequently, businesses are investing in advanced cold chain solutions to ensure compliance with safety standards, thereby propelling the Cold Chain Temperature Monitoring Market.

Focus on Food Safety and Quality Assurance

The growing emphasis on food safety and quality assurance is a key driver for the Cold Chain Temperature Monitoring Market. Consumers are increasingly aware of foodborne illnesses and the importance of maintaining proper temperature controls throughout the supply chain. This awareness is prompting food manufacturers and distributors to adopt stringent monitoring practices to ensure product integrity. The market for food safety solutions is projected to grow at a rate of approximately 6% annually, reflecting the rising consumer demand for safe and high-quality food products. As a result, companies are prioritizing investments in temperature monitoring technologies to enhance their food safety protocols, thereby driving the Cold Chain Temperature Monitoring Market.

Growth of E-commerce and Online Grocery Delivery

The rapid expansion of e-commerce, particularly in the grocery sector, is significantly influencing the Cold Chain Temperature Monitoring Market. As more consumers turn to online platforms for their grocery needs, the demand for efficient cold chain logistics increases. This shift necessitates reliable temperature monitoring solutions to ensure that perishable items are delivered in optimal condition. Industry reports suggest that the online grocery market is expected to grow by over 20% in the coming years, further emphasizing the need for effective cold chain management. Consequently, businesses are investing in advanced temperature monitoring systems to enhance their logistics capabilities and meet consumer expectations.

Technological Advancements in Monitoring Solutions

Technological innovations, particularly in sensor technology and data analytics, are transforming the Cold Chain Temperature Monitoring Market. The advent of smart sensors and IoT-enabled devices allows for real-time monitoring of temperature and humidity levels throughout the supply chain. These advancements not only enhance the accuracy of temperature control but also facilitate predictive analytics, enabling companies to preemptively address potential issues. The market for temperature monitoring solutions is expected to witness a growth rate of around 8% annually, driven by these technological enhancements. As a result, businesses are increasingly adopting sophisticated monitoring systems to optimize their cold chain operations.