Increasing Regulatory Requirements

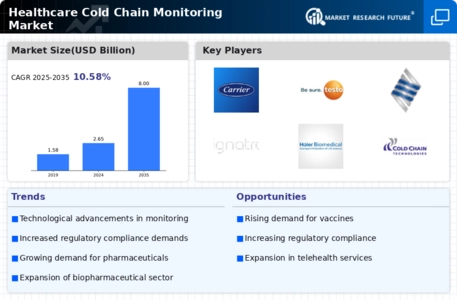

The Healthcare Cold Chain Monitoring Market is significantly influenced by increasing regulatory requirements. Regulatory bodies are imposing stringent guidelines to ensure the safety and efficacy of temperature-sensitive products. For instance, the FDA and EMA have established comprehensive regulations that mandate the monitoring of storage conditions for pharmaceuticals and biologics. Compliance with these regulations is essential for market players, as non-compliance can lead to severe penalties and product recalls. As a result, companies are investing in advanced cold chain monitoring solutions to meet these regulatory demands. The market for compliance-driven cold chain solutions is projected to grow, reflecting the heightened focus on regulatory adherence. This trend indicates that the Healthcare Cold Chain Monitoring Market will continue to evolve, driven by the necessity for compliance and the protection of public health.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a pivotal driver for the Healthcare Cold Chain Monitoring Market. As the biopharmaceutical sector expands, the need for stringent temperature control during transportation and storage becomes paramount. According to industry reports, the biopharmaceutical market is projected to reach USD 500 billion by 2025, necessitating robust cold chain solutions to maintain product integrity. This surge in biopharmaceuticals, including vaccines and monoclonal antibodies, underscores the critical role of cold chain monitoring systems. These systems ensure that temperature-sensitive products are stored and transported within specified limits, thereby reducing the risk of spoilage and ensuring patient safety. Consequently, the Healthcare Cold Chain Monitoring Market is likely to experience substantial growth as stakeholders seek reliable solutions to meet these evolving demands.

Growth of E-commerce in Pharmaceuticals

The growth of e-commerce in the pharmaceutical sector is a significant driver for the Healthcare Cold Chain Monitoring Market. As online pharmacies and telehealth services gain traction, the demand for efficient cold chain logistics has surged. E-commerce platforms require reliable cold chain solutions to ensure that temperature-sensitive products are delivered safely and efficiently. Market analysis suggests that the e-pharmacy market is expected to reach USD 100 billion by 2025, further emphasizing the need for robust cold chain monitoring systems. This shift towards online distribution channels necessitates enhanced tracking and monitoring capabilities to maintain product quality during transit. Consequently, the Healthcare Cold Chain Monitoring Market is likely to benefit from this trend, as stakeholders seek to implement effective solutions that cater to the unique challenges posed by e-commerce.

Focus on Patient Safety and Quality Assurance

The focus on patient safety and quality assurance is a critical driver for the Healthcare Cold Chain Monitoring Market. As healthcare providers prioritize the delivery of safe and effective treatments, the integrity of temperature-sensitive products becomes increasingly vital. Ensuring that vaccines, biologics, and other pharmaceuticals are stored and transported under optimal conditions is essential for maintaining their efficacy. Reports indicate that improper handling of temperature-sensitive products can lead to significant financial losses and health risks. As a result, healthcare organizations are investing in advanced cold chain monitoring solutions to enhance quality assurance processes. This emphasis on patient safety is likely to propel the Healthcare Cold Chain Monitoring Market forward, as stakeholders recognize the importance of maintaining product integrity throughout the supply chain.

Technological Advancements in Monitoring Solutions

Technological advancements are significantly shaping the Healthcare Cold Chain Monitoring Market. Innovations such as real-time tracking, automated alerts, and data analytics are enhancing the efficiency and reliability of cold chain operations. The integration of IoT devices allows for continuous monitoring of temperature and humidity levels, providing stakeholders with actionable insights. Reports indicate that the market for cold chain monitoring solutions is expected to grow at a CAGR of 15% over the next five years, driven by these technological enhancements. As healthcare providers and logistics companies increasingly adopt these advanced solutions, the Healthcare Cold Chain Monitoring Market is poised for robust expansion. The ability to leverage technology not only improves compliance with regulatory standards but also enhances operational efficiency, thereby attracting more investments into the sector.