Growing Focus on Customer Experience

In the IT Robotic Process Automation Market, there is an increasing emphasis on enhancing customer experience. Organizations are utilizing RPA to automate customer service processes, thereby improving response times and service quality. By automating routine inquiries and transactions, businesses can provide faster and more accurate services to their customers. Data suggests that companies employing RPA in customer service have seen a 20% increase in customer satisfaction scores. This focus on customer experience is driving investments in RPA technologies, as organizations strive to differentiate themselves in a competitive market. As customer expectations continue to evolve, the IT Robotic Process Automation Market is likely to see sustained growth driven by the need for improved service delivery.

Rising Adoption of Cloud Technologies

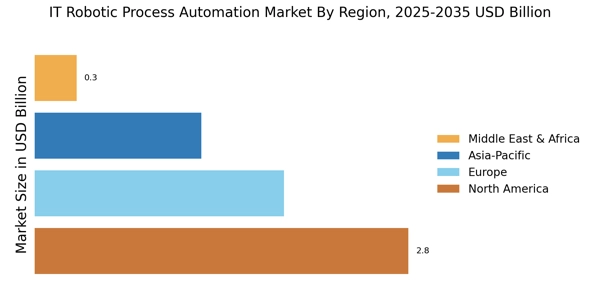

The IT Robotic Process Automation Market is witnessing a notable increase in the adoption of cloud technologies. As organizations migrate to cloud-based solutions, the integration of RPA becomes more seamless and efficient. Cloud-based RPA solutions offer scalability, flexibility, and cost-effectiveness, which are essential for modern businesses. Recent statistics indicate that the cloud RPA market is expected to grow at a compound annual growth rate of over 25% in the coming years. This shift towards cloud technologies not only enhances the accessibility of RPA tools but also facilitates real-time data processing and analytics. Consequently, the IT Robotic Process Automation Market is likely to benefit from this trend, as more companies leverage cloud capabilities to enhance their automation strategies.

Regulatory Compliance and Risk Management

The IT Robotic Process Automation Market is increasingly influenced by the need for regulatory compliance and effective risk management. Organizations are facing mounting pressure to adhere to stringent regulations across various sectors, including finance, healthcare, and manufacturing. RPA can play a crucial role in ensuring compliance by automating data entry, reporting, and audit processes, thereby minimizing human error. Recent findings indicate that companies utilizing RPA for compliance purposes have reduced audit times by up to 40%. This capability not only enhances compliance but also mitigates risks associated with non-compliance. As regulatory landscapes continue to evolve, the IT Robotic Process Automation Market is expected to grow as organizations seek reliable solutions to manage compliance and risk.

Increased Demand for Operational Efficiency

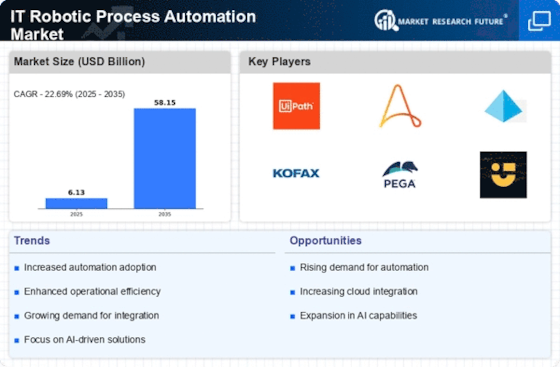

The IT Robotic Process Automation Market is experiencing a surge in demand for operational efficiency across various sectors. Organizations are increasingly recognizing the potential of RPA to streamline processes, reduce operational costs, and enhance productivity. According to recent data, companies implementing RPA have reported up to a 30% reduction in process cycle times. This trend is likely to continue as businesses seek to optimize their operations and remain competitive in a rapidly evolving landscape. The ability of RPA to automate repetitive tasks allows human resources to focus on more strategic initiatives, thereby driving innovation and growth. As a result, the IT Robotic Process Automation Market is poised for substantial growth, with organizations investing heavily in RPA technologies to achieve their efficiency goals.

Advancements in Machine Learning and AI Integration

The IT Robotic Process Automation Market is significantly impacted by advancements in machine learning and artificial intelligence. The integration of AI technologies into RPA solutions enhances their capabilities, allowing for more intelligent automation. This synergy enables RPA systems to learn from data patterns, make decisions, and adapt to changing environments. Recent projections suggest that the market for AI-driven RPA solutions could reach a valuation of several billion dollars within the next few years. As organizations increasingly seek to leverage AI for process optimization, the demand for RPA solutions that incorporate machine learning is likely to rise. Consequently, the IT Robotic Process Automation Market is poised for growth as businesses adopt these advanced technologies to enhance their automation efforts.