Expansion in Polyester Production

The Isophthalic Acid Market is significantly influenced by the expansion of polyester production, particularly in the textile and packaging sectors. Polyester, which is derived from isophthalic acid, is widely used due to its excellent strength, durability, and resistance to wrinkling. The textile industry, which has been growing steadily, is expected to witness a surge in polyester demand, potentially increasing the consumption of isophthalic acid. Recent estimates suggest that the polyester market could reach a valuation of over USD 100 billion by 2026, indicating a substantial opportunity for isophthalic acid producers. This expansion not only highlights the importance of isophthalic acid in polyester synthesis but also underscores its critical role in meeting the evolving needs of various industries.

Growth in Automotive Applications

The Isophthalic Acid Market is poised for growth due to the increasing utilization of isophthalic acid in automotive applications. As manufacturers strive to produce lightweight and fuel-efficient vehicles, the demand for advanced materials that can withstand high temperatures and provide structural integrity is rising. Isophthalic acid is integral in the production of high-performance resins and composites used in automotive components. The automotive sector is projected to grow at a CAGR of around 4% in the coming years, which could lead to a corresponding increase in isophthalic acid consumption. This trend suggests that the isophthalic acid market will benefit from the automotive industry's shift towards innovative materials that enhance vehicle performance and sustainability.

Rising Demand in Coatings and Adhesives

The Isophthalic Acid Market is experiencing a notable increase in demand from the coatings and adhesives sector. This growth is primarily driven by the need for high-performance materials that offer durability and resistance to environmental factors. The coatings industry, which utilizes isophthalic acid for its superior properties, is projected to expand at a compound annual growth rate (CAGR) of approximately 5% over the next few years. This trend indicates a robust market potential for isophthalic acid, as manufacturers seek to enhance product performance and longevity. Furthermore, the increasing focus on aesthetic appeal in construction and automotive applications further propels the demand for isophthalic acid-based coatings, thereby solidifying its position in the market.

Emerging Markets and Economic Development

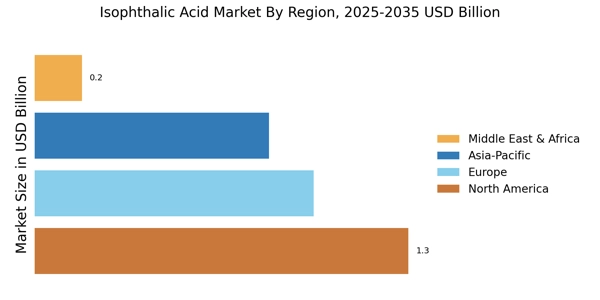

The Isophthalic Acid Market is likely to benefit from the economic development in emerging markets, where industrialization and urbanization are accelerating. Countries in Asia and Latin America are witnessing a surge in construction and manufacturing activities, leading to increased demand for isophthalic acid in various applications, including coatings, adhesives, and plastics. The construction sector, in particular, is expected to grow significantly, with investments in infrastructure projects driving the need for high-quality materials. This trend indicates a potential increase in isophthalic acid consumption, as manufacturers in these regions seek to meet the rising demand for durable and efficient products. The economic growth in these markets presents a promising opportunity for stakeholders in the isophthalic acid industry.

Innovations in Chemical Manufacturing Processes

The Isophthalic Acid Market is experiencing a transformation due to innovations in chemical manufacturing processes. Advances in production techniques, such as more efficient catalytic processes and the use of renewable feedstocks, are enhancing the sustainability and cost-effectiveness of isophthalic acid production. These innovations not only reduce the environmental impact of manufacturing but also improve the overall quality of the end product. As companies increasingly prioritize sustainability, the adoption of these advanced manufacturing processes is likely to drive growth in the isophthalic acid market. Furthermore, the potential for reduced production costs may lead to increased competitiveness, allowing manufacturers to expand their market share and meet the evolving demands of various industries.