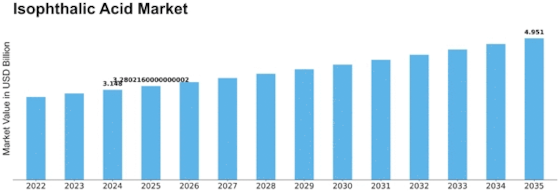

Isophthalic Acid Size

Isophthalic Acid Market Growth Projections and Opportunities

Many factors shape the Isophthalic Acid market. The growing interest from end-use ventures is a key driver. A key ingredient, isophthalic acid, is used to make gums, coatings, and polymers. The growing use of these products in auto, development, and electronics drives Isophthalic Acid demand, boosting market growth.

Financial variables also affect the Isophthalic Acid market. Synthetic compound use is directly affected by global economic conditions including GDP growth, expansion rates, and modern result. Isophthalic Acid demand rises when economies grow, reflecting the company's dislike of financial stability. Financial slumps may reduce popularity, hurting the market.

Natural ingredient accessibility and evaluation also impact the Isophthalic Acid market. Para-xylene is the feedstock for Isophthalic Acid, so price changes affect production costs. International scene and exchange procedures affect unrefined component inventory network elements, possibly affecting market security.

Natural regulations and manageability issues shape the Isophthalic Acid market. Producers must follow strict natural rules as green innovations and controllable methods gain popularity. This has led to eco-friendly production methods and bio-based alternatives. Companies that align with these natural goals often obtain a competitive edge, affecting market factors.

Another key element of the Isophthalic Acid market is the serious scene. Important players, their market share, and main drivers intensify the business. Mechanical advances, product developments, and market player collaborations can influence market growth.

Global events and trade strategies also impact the Isophthalic Acid market. Levies, exchange pressures, and political interactions between major economies can disrupt the inventory network and market. Isophthalic Acid companies must address these international issues to ensure job consistency and maintain a competitive edge.

Buyer preferences and end-use industry trends enhance the Isophthalic Acid market. Makers should adapt their methods to meet end-users' growing demand for more manageable and effective presentation materials. To be competitive, companies must develop products and prioritize customer wants.

Leave a Comment