North America : Market Leader in Fund Services

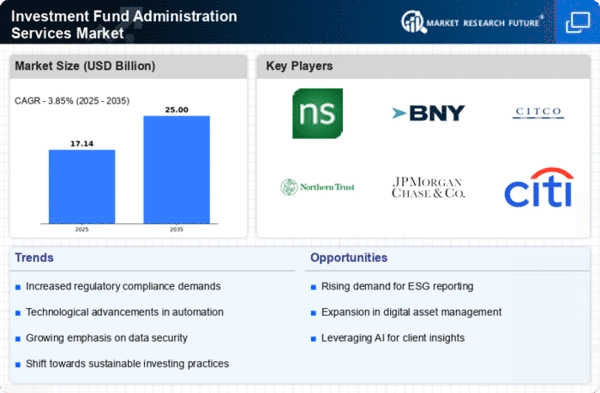

North America continues to lead the Investment Fund Administration Services Market, holding a significant market share of 8.25 in 2024. The region's growth is driven by increasing demand for efficient fund management solutions, regulatory compliance, and technological advancements. The presence of major financial institutions and a robust investment landscape further catalyze market expansion, making it a hub for fund administration services.

The competitive landscape in North America is characterized by key players such as State Street Corporation, BNY Mellon, and J.P. Morgan Chase & Co. These firms leverage advanced technology and extensive networks to provide comprehensive services. The U.S. remains the largest market, supported by favorable regulations and a strong financial ecosystem, ensuring continued growth in the sector.

Europe : Emerging Market with Growth Potential

Europe's Investment Fund Administration Services Market is poised for growth, with a market size of 4.95. The region benefits from increasing cross-border investments and a focus on regulatory compliance, which drives demand for fund administration services. The European Union's regulatory framework, including the AIFMD, enhances transparency and investor protection, further stimulating market growth.

Leading countries in this region include the UK, Germany, and France, where major players like Citco Group Limited and HSBC Holdings plc operate. The competitive landscape is evolving, with firms investing in technology to improve service delivery. As Europe adapts to changing market dynamics, the presence of established financial institutions ensures a robust environment for fund administration services.

Asia-Pacific : Growing Demand for Fund Services

The Asia-Pacific region is witnessing a growing demand for Investment Fund Administration Services, with a market size of 2.75. Factors such as increasing wealth, a rising number of high-net-worth individuals, and regulatory reforms are driving this growth. Countries like China and India are experiencing rapid economic development, leading to a surge in investment activities and the need for efficient fund administration solutions.

Key players in the region include Northern Trust Corporation and Apex Group Ltd., which are expanding their services to cater to the evolving market needs. The competitive landscape is becoming more dynamic, with local firms emerging alongside established global players. As the region continues to develop, the demand for sophisticated fund administration services is expected to rise significantly.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region represents an emerging market for Investment Fund Administration Services, with a market size of 0.45. The growth is driven by increasing foreign investments and a focus on diversifying economies. Regulatory initiatives aimed at enhancing transparency and investor confidence are also contributing to the market's development, creating opportunities for fund administration services.

Countries like the UAE and South Africa are at the forefront of this growth, with key players such as Vistra Group Limited establishing a presence. The competitive landscape is evolving, with both local and international firms vying for market share. As the region continues to attract investments, the demand for efficient fund administration services is expected to rise, presenting significant growth opportunities.