North America : Innovation and Investment Hub

North America dominates the Venture Capital Fund Advisory Services Market, holding a significant market share of 12.5 in 2024. The region's growth is driven by a robust startup ecosystem, technological advancements, and favorable regulatory frameworks. Increased investment in emerging technologies and a surge in entrepreneurial activities are key demand trends, supported by government initiatives that encourage innovation and investment in high-growth sectors.

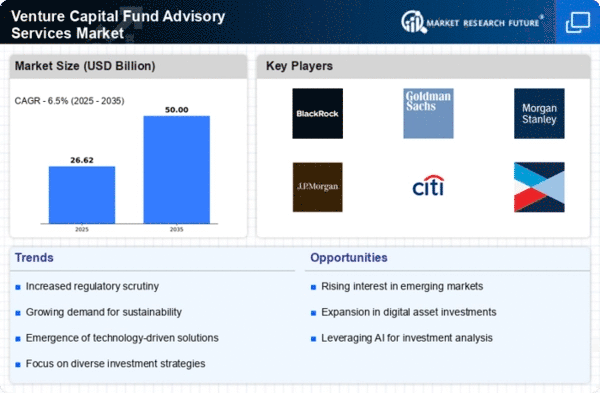

The competitive landscape in North America is characterized by the presence of major players such as BlackRock, Goldman Sachs, and J.P. Morgan. The U.S. remains the leading country, with a concentration of venture capital firms and a strong network of investors. This environment fosters collaboration and accelerates the growth of startups, making it an attractive destination for venture capital investments. The region's established financial infrastructure further enhances its appeal to both domestic and international investors.

Europe : Emerging Market with Potential

Europe's Venture Capital Fund Advisory Services Market is on the rise, with a market size of 7.5 in 2024. The region benefits from a diverse economy, increasing digitalization, and supportive government policies aimed at fostering innovation. Regulatory frameworks are evolving to enhance investment opportunities, and initiatives like the European Investment Fund are catalyzing growth in the venture capital sector, driving demand for advisory services across various industries.

Leading countries in Europe include the UK, Germany, and France, where a vibrant startup culture is emerging. Key players such as Index Ventures and other local firms are actively investing in technology and healthcare sectors. The competitive landscape is becoming increasingly dynamic, with a growing number of venture capital firms entering the market, enhancing the overall investment ecosystem and providing more opportunities for startups to secure funding.

Asia-Pacific : Rapidly Growing Investment Landscape

The Asia-Pacific region is witnessing significant growth in the Venture Capital Fund Advisory Services Market, with a market size of 4.5 in 2024. This growth is fueled by a burgeoning middle class, increasing digital adoption, and government initiatives promoting entrepreneurship. Countries like China and India are leading the charge, with favorable regulations and a growing number of startups attracting substantial investments, thereby driving demand for advisory services in the region.

China and India are the frontrunners in the Asia-Pacific market, with a competitive landscape that includes both local and international venture capital firms. The presence of key players is expanding, as firms seek to capitalize on the region's growth potential. The increasing collaboration between startups and venture capitalists is fostering innovation, making Asia-Pacific a hotspot for venture capital investments and advisory services.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region is in the nascent stages of developing its Venture Capital Fund Advisory Services Market, with a market size of 0.5 in 2024. The region is characterized by a growing interest in entrepreneurship, supported by government initiatives aimed at diversifying economies and fostering innovation. Regulatory frameworks are gradually improving, creating a more conducive environment for venture capital investments and advisory services.

Countries like the UAE and South Africa are leading the way in venture capital activities, with a rising number of startups and investment opportunities. The competitive landscape is evolving, with both local and international players entering the market. As the region continues to develop its venture capital ecosystem, the potential for growth in advisory services is significant, driven by increasing investments in technology and innovation.